GE Aerospace, led by Russell Stokes, finds itself navigating persistent challenges within the global supply chain landscape. Despite a coordinated effort to align production rates with Boeing’s current needs, Stokes acknowledges that significant hurdles are likely to persist not only throughout this year but also well into the next.

Stokes remains cautiously optimistic about the future, noting, “I’m confident that over time things are going to get better.” However, he underscores the ongoing difficulties, cautioning that the environment remains “challenged” for both 2023 and potentially extending into 2024.

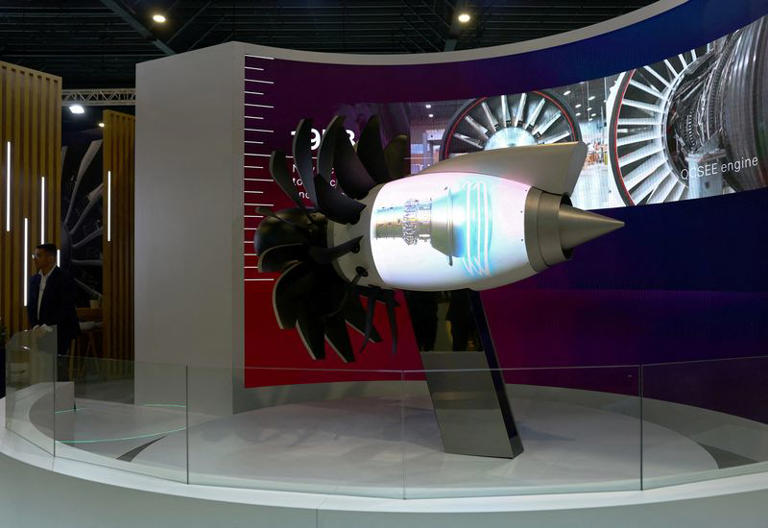

A pivotal aspect of GE Aerospace’s operations involves its collaboration with Safran, a partnership through their CFM joint venture. This alliance focuses on producing engines for Boeing and Airbus narrow-body jets, particularly serving as the sole supplier for Boeing’s 737 MAX family of aircraft. The recent slowdown in Boeing’s production, triggered by heightened regulatory scrutiny following incidents like the mid-air door plug incident on an Alaska Airlines jetliner, has had ripple effects across GE Aerospace’s production estimates, particularly for their LEAP jet engines.

While the production slowdown at Boeing could alleviate pressure on the strained supply chain by allowing it time to catch up with demand, there’s also a risk that it could exacerbate existing challenges. Stokes acknowledges this delicate balance, emphasizing the need for careful management amid these dynamics.

Larry Culp, CEO of GE Aerospace, has attributed many of these ongoing supply chain challenges to the lingering impacts of the COVID-19 pandemic. The drastic decline in air travel demand during the pandemic forced the aviation industry into substantial layoffs and disruptions, further complicating efforts to stabilize and streamline operations.

The ramifications of these supply chain bottlenecks extend beyond production rates. They have also significantly increased turnaround times at jet engine repair facilities, which airline CEOs have identified as a critical constraint for the industry.

To mitigate these challenges, GE Aerospace has adopted proactive measures. The company, which recently became an independent entity, commands a dominant share in the narrow-body jet engine market and holds a robust position in wide-body aircraft as well. Over 70% of its commercial engine revenue is derived from parts and services, underscoring the critical role of its aftermarket support.

In response to material availability issues, GE Aerospace has deployed approximately 500 engineers to supplier and sub-supplier sites. Leveraging advanced technologies like artificial intelligence (AI), the company is striving to overcome supply chain bottlenecks. For instance, it plans to implement AI-driven solutions originally developed for identifying forged artwork to detect chemical anomalies in metal parts. This innovative approach forms part of GE Aerospace’s broader strategy to achieve a 30% reduction in overall turnaround times at its repair shops compared to the previous year.

Stokes emphasizes the company’s commitment to supporting airlines’ fleet requirements, stating, “We’re doing everything that we can in support of that.” This steadfast dedication underscores GE Aerospace’s proactive stance amidst the evolving challenges within the aviation industry’s supply chain.

In conclusion, GE Aerospace, under Russell Stokes’ leadership, continues to navigate complex supply chain dynamics with resilience and innovation. While challenges persist, the company’s strategic initiatives and technological advancements position it to adapt and thrive in an increasingly competitive and demanding market environment.