It’s undeniable: John Bogle has emerged victorious. Despite early skepticism, the founder of Vanguard Group championed the idea that low-cost index funds tracking the S&P 500 would outperform most active managers. Nearly five decades since the launch of the Vanguard 500 Index fund in August 1976, any doubts about Bogle’s vision have been dispelled. In a historic milestone, index fund assets in the U.S. surpassed those of active funds for the first time in the first quarter of 2024, with the Vanguard 500 Index fund alone exceeding $1 trillion in assets.

However, this triumph is not without its risks. While Bogle advocated for indexing and diversification, the S&P 500 has faced a unique challenge due to its own success. The index’s largest constituents, particularly in the technology sector, have grown so dominant that they now overshadow other components. This concentration in a few mega-cap stocks, reminiscent of the dot-com bubble era, poses risks to index investors.

The current landscape sees three of the market’s top performers—Amazon.com, Meta Platforms, and Alphabet—classified not as tech companies but as consumer and communication stocks within the S&P 500. This classification understates the tech sector’s influence, making the market more concentrated than it has been in over half a century. Ben Inker, co-head of asset allocation at GMO, warns that the market’s concentration is unprecedented.

Despite these concerns, experts advise against selling S&P 500 index funds outright. Many view the Magnificent Seven—the leading stocks driving the market—as high-quality companies with promising prospects. However, their lofty valuations necessitate flawless execution, as evidenced by Tesla’s recent struggles due to earnings missteps. While companies like Nvidia garner enthusiasm for their role in artificial intelligence, skepticism remains about their long-term dominance and the emergence of potential disruptors.

In essence, while the S&P 500 index funds remain a cornerstone of many investors’ portfolios, the concentration of market power in a few tech giants underscores the need for caution and vigilance in navigating the ever-evolving landscape of the stock market.

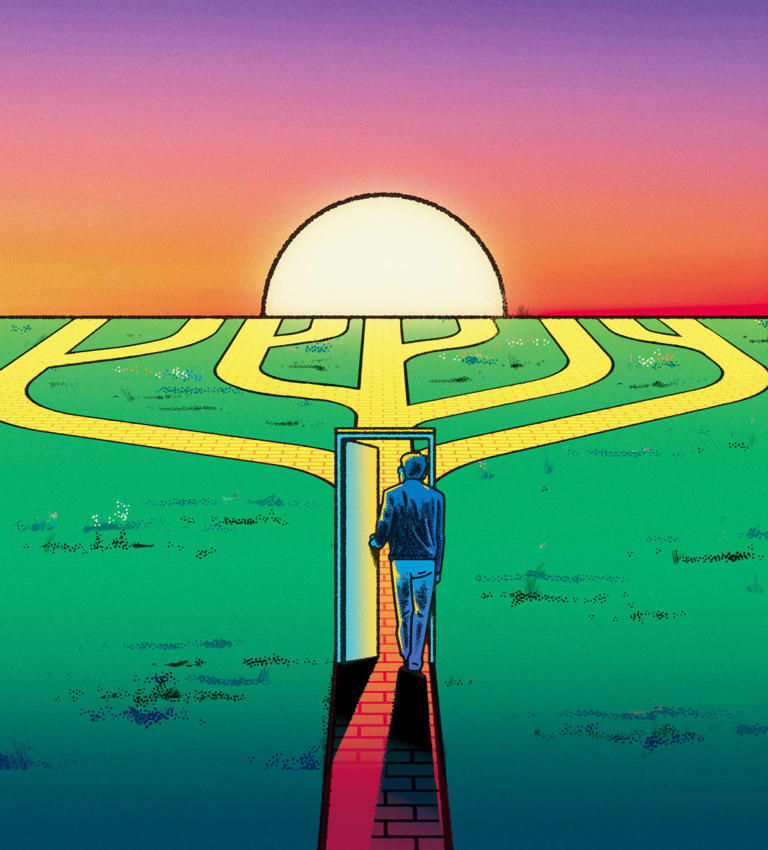

For many investors, an S&P 500 fund serves as the mainstay of their investment strategy—a hearty main course, if you will. However, just like any well-rounded meal, it’s essential to complement this core holding with appetizer funds and perhaps a fine wine fund to truly round out your investment palate.

While bonds are often likened to the vegetables in your meal—providing necessary diversification—many investors still seek a healthy dose of equity exposure in their financial portfolios. Yet, achieving true equity diversification can be challenging. Even widely diversified funds like the popular Vanguard Total Stock Market ETF, with its extensive roster of over 3,700 stocks, still maintains a significant tech weighting of around 30%.

To break away from this tech-dominated landscape and achieve genuine equity diversification, investors may need to explore alternative strategies. One approach is to seek out stock funds with minimal or no exposure to the tech sector. Another strategy involves identifying funds with low correlations to the S&P 500 index, a measure often denoted by R-Squared (R2). A lower R2 indicates a weaker correlation to the benchmark index, offering potential diversification benefits.

When it comes to large-cap funds, finding options with minimal tech exposure can be challenging but not impossible. Marshfield Concentrated Opportunity, for instance, boasts a relatively low R2 of 75 over the past three years, indicating less correlation to the S&P 500. This fund has demonstrated strong downside risk control, outperforming the market during downturns while delivering competitive long-term returns.

Marshfield’s strategy emphasizes holding a concentrated portfolio of high-quality stocks that can weather market volatility. By selecting companies less tied to the typical business cycle, Marshfield aims to deliver performance that diverges from the broader market.

Similarly, small-cap value stocks present an avenue for diversification, especially given their underperformance during the recent tech bull run. Funds like the Avantis U.S. Small-Cap Value ETF offer exposure to value-oriented companies with minimal tech exposure and attractive valuation metrics compared to their large-cap counterparts.

However, investors must tread cautiously, particularly in a high-interest-rate environment where overleveraged small companies may face heightened risks. Seeking out high-quality small-cap stocks with robust cash flows or minimal debt can mitigate some of these risks.

For investors seeking the stability of mid- and large-cap value stocks, funds like the Pacer U.S. Cash Cows 100 ETF offer exposure to companies with strong free cash flow yields. By focusing on fundamentals like free cash flow rather than market capitalization, these funds provide an alternative approach to traditional index investing.

Additionally, sector funds can offer unique diversification benefits, particularly when paired with broad-market index funds like the S&P 500. Precious metals funds, for example, tend to have low correlations with the S&P 500 and may serve as effective inflation hedges. Similarly, utilities funds can offer stability in uncertain market conditions, while energy funds may benefit from inflationary pressures.

Ultimately, achieving true diversification requires a thoughtful and nuanced approach, considering factors such as correlation, sector exposure, and market dynamics. By carefully selecting complementary funds to accompany your S&P 500 holdings, you can create a well-balanced investment portfolio that’s better equipped to navigate a variety of market environments.