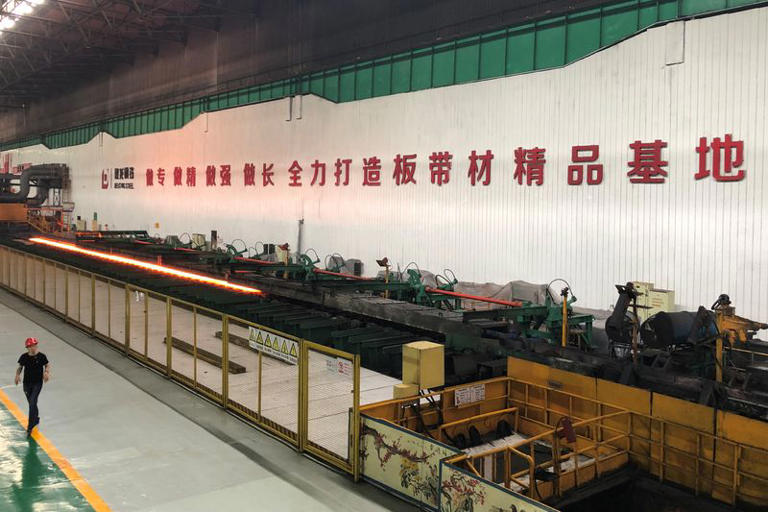

Jiangsu Delong Nickel Industry is a prominent player in the global stainless steel market, founded in 2010 by Dai Guofang. Delong is a significant part of China’s stainless steel production landscape, operating with substantial capacity both domestically and internationally. Its facilities in China include three smelting plants located in Xiangshui county, Jiangsu province, and its production capacity reaches 5 million metric tons. Additionally, Delong has expanded its operations to Indonesia, where it has a capacity of 2.5 million metric tons. In 2022, the company reported impressive revenues of 169.5 billion yuan (approximately $23.4 billion), reflecting its scale and influence in the industry.

Historical Context: Dai Guofang, the founder of Delong, had a contentious history prior to the establishment of the company. In the early 2000s, he faced legal issues related to his previous venture, Jiangsu Tieben Steel, which led to a five-year detention on charges of tax evasion. These legal troubles arose after he expanded his steel production capacity without the necessary approvals. Despite these setbacks, Dai’s return to the industry with Jiangsu Delong marked a significant recovery and success.

Current Situation and Potential Outcomes

Jiangsu Delong is currently undergoing financial difficulties that have prompted discussions about potential bankruptcy reorganization. The company is facing a complex situation due to several factors including financial strain, fluctuating market conditions, and operational challenges.

Government Intervention: In response to these challenges, several industry insiders anticipate that the Chinese government might step in to stabilize the situation. Given China’s emphasis on economic stability and avoiding disruptive corporate failures, it is expected that state-owned enterprises may absorb some of Delong’s operations. This approach is aimed at mitigating any potential ripple effects that a complete collapse might have on the broader economy.

Reports indicate that four Delong-related firms are now under government supervision. This intervention involves the management and oversight of these entities by government-affiliated organizations, including Xiamen Xiangyu, a major commodities firm controlled by the government of Xiamen. This move suggests that the government is actively working to manage the fallout from Delong’s financial difficulties.

Market Reactions: Despite the ongoing issues, the immediate impact on the stainless steel market has been relatively contained. According to Kevin Bai, an analyst at CRU Group, the market has remained stable and has not experienced significant volatility. This stability can be attributed to the fact that Delong’s difficulties were somewhat anticipated, and previous similar cases in China have shown minimal impact on production and market prices. Additionally, Delong’s previous role in acquiring Jiangsu Shengte Steel Co during its bankruptcy in 2020 highlights the company’s ability to navigate financial challenges.

Contributing Factors to Delong’s Financial Difficulties

Delong’s financial troubles are rooted in several factors:

Rapid Expansion and Investment: Delong’s aggressive expansion strategy, particularly its investments in Indonesia, has contributed to its current predicament. As the metals and mining sector in Southeast Asia experienced rapid growth, Delong invested heavily in this region. However, this expansion was accompanied by rising costs and declining prices for key materials, such as ferro-nickel.

Financial Losses: One of the major issues facing Delong is the financial losses incurred by its Indonesian joint venture, in which it holds a 48% stake. This venture reported significant annual losses estimated between 1.8 and 2.2 billion yuan due to falling ferro-nickel prices and rising material costs. The financial strain has been compounded by the freezing of Delong’s stakes in subsidiaries worth over 4 billion yuan by Chinese courts.

Proceedings and Future Steps

Bankruptcy Reorganization Request: In light of the company’s financial difficulties, four firms controlled by Xiangshui county have formally requested the court to approve bankruptcy reorganization for Delong and three associated companies. The court’s decision will determine whether an administrator will be appointed to draft a reorganization plan. This process is crucial for restructuring the company’s finances and operations.

Administrative Process: The court has set a deadline of July 29 for potential administrators to apply for the role. If approved, the reorganization plan will outline the steps needed to stabilize and potentially rehabilitate the company. The involvement of government entities in overseeing this process underscores the importance of maintaining stability in the face of corporate distress.

Conclusion

Jiangsu Delong Nickel Industry’s current financial situation reflects the broader challenges faced by large-scale industrial operations in a dynamic global market. The company’s difficulties, while significant, are being managed with government intervention and strategic oversight. The potential reorganization of Delong highlights the intricate balance between corporate stability and economic impact, demonstrating the complex nature of managing large enterprises under financial distress. The outcome of these proceedings will be closely watched for its implications on the stainless steel market and the broader economic landscape.