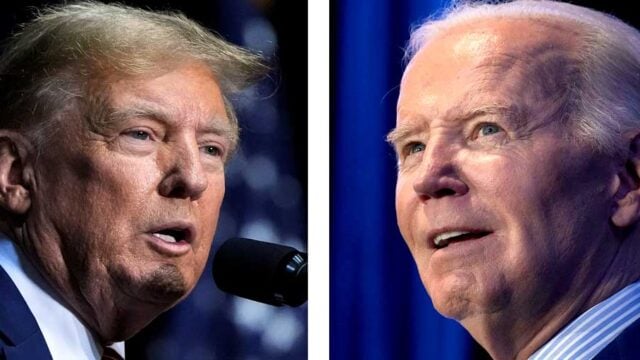

On Friday, the U.S. stock market prepared for a positive opening, with Dow Jones futures showing a slight uptick alongside gains in S&P 500 futures and Nasdaq futures. This followed a pivotal presidential debate the previous evening, where President Joe Biden faced criticism for his performance compared to former President Donald Trump. The debate, a significant event ahead of the 2024 elections, influenced market sentiment as polls leading up to the event had shown Trump as a slight favorite to potentially reclaim the presidency, which added an element of uncertainty for investors assessing future policy directions.

Thursday’s trading session had seen modest gains across major indexes, with particular strength noted in small-cap stocks, which outperformed larger counterparts. However, it was the software sector that stood out prominently, continuing a robust rebound observed over the past month. Key players like Monday.com, Zeta, CyberArk Software, Datadog, ServiceNow, AppLovin, and AppFolio flashed buy signals, reflecting renewed investor confidence in this segment’s growth potential.

Meta Platforms made significant moves by breaking out on Thursday, a development closely watched by market participants, while Amazon.com and Tesla extended their previous day’s breakout gains. Conversely, Nike, a Dow component, faced challenges after reporting mixed earnings results that missed sales expectations, leading to a steep 15% decline in its stock early Friday.

Amidst these developments, anticipation mounted for the release of the Personal Consumption Expenditures (PCE) price index by the Commerce Department, scheduled for early Friday. The PCE index is pivotal as it serves as the Federal Reserve’s preferred gauge of inflation. Analysts expected a slight uptick in the overall PCE price index from April, while the core PCE price index, which excludes volatile food and energy prices, was forecasted to show a moderate increase, remaining above the Fed’s 2% target. These figures were closely watched as they could influence the Fed’s future monetary policy decisions, particularly regarding interest rates.

In the futures market, Dow Jones futures traded slightly above fair value despite the drag from Nike’s stock performance. S&P 500 futures showed a 0.4% increase, and Nasdaq 100 futures climbed by 0.5%. Concurrently, the 10-year Treasury yield edged up to 4.31%, indicating investor confidence amid economic data releases. Crude oil futures also saw a slight rise, trading above $82 per barrel, reflecting ongoing supply-demand dynamics and geopolitical factors influencing global markets.

Market sentiment remained resilient despite individual stock movements, with investors navigating sector rotations and specific stock performances within software, megacap companies, and other key sectors like financials and industrials. These rotations highlighted shifting investor preferences amidst evolving economic conditions and corporate earnings reports.

Overall, while the market maintained a cautiously optimistic outlook, influenced by political developments and impending economic data releases, investors continued to monitor sector-specific trends and broader market indicators to effectively navigate their investment strategies amidst fluctuating global uncertainties.