Dell Technologies’ recent earnings report and subsequent conference call have sparked significant discussion and analysis, particularly regarding the company’s profitability in selling artificial intelligence (AI) servers. While Dell’s financial results for the April quarter exceeded Street estimates, concerns were raised about its margins, notably within the infrastructure services group, which encompasses servers, storage, and networking equipment. Although this segment reported revenue of $9.2 billion, representing a commendable 22% year-over-year increase, there were qualms about the profitability of AI server sales within this category.

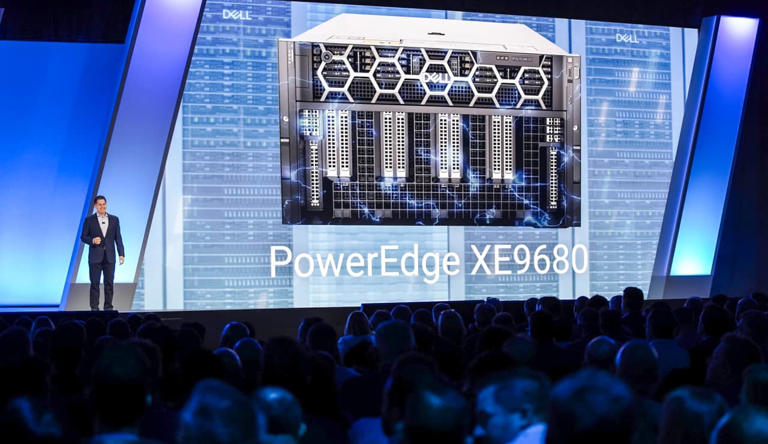

The surge in shipments of AI servers by over 100% sequentially to $1.7 billion contributed substantially to the segment’s revenue growth. However, the backlog of orders for AI servers, standing at $3.8 billion, fell short of expectations, raising questions about the strength of demand for these servers. Mizuho analyst Jordan Klein emphasized that the backlog figure missed the anticipated range of $4.5 billion to $5 billion, signaling weaker-than-expected demand for AI servers. Klein also underscored Nvidia’s dominance in the market for GPU-optimized hardware and systems, leaving limited profitability for other players such as Dell.

During the conference call, Bernstein analyst Toni Sacconaghi expressed concerns about Dell’s operating margins for AI servers, questioning whether the company was selling them at near-zero margins. Dell’s CFO, Yvonne McGill, acknowledged that AI servers were margin rate dilutive but margin dollar accretive for Dell. This means that while the company earns lower margins on AI servers compared to other hardware, the overall net income from selling AI servers remains higher.

However, Sacconaghi remained skeptical about the profitability of AI servers, estimating their operating margins to be around 5% in the latest quarter. He suggested that the poor incremental profitability from AI servers could limit near-term earnings upside for Dell. Despite these concerns, Sacconaghi remained bullish on Dell’s long-term AI opportunity and maintained an Outperform rating on the company with a target price of $155.

In the long run, C3.ai CEO Tom Siebel believes that the bulk of the value in AI will accrue to application providers rather than infrastructure providers like Dell. He emphasized that while silicon and infrastructure may command value in the short term, they are prone to commoditization over time, with the real value residing in AI applications.

Despite the challenges posed by AI server margins and margin guidance revisions, analysts like Ben Reitzes of Melius Research remain optimistic about Dell’s prospects. Reitzes sees potential in Dell’s AI server business and believes that the company’s diversified portfolio, including PC sales and storage solutions, positions it for long-term growth. However, Dell’s shares have experienced a significant decline following the earnings report, reflecting investor concerns about the company’s profitability in the AI server market.