Many individuals find themselves grappling with financial challenges, often juggling the need to cover monthly expenses while also striving to secure their financial futures. It’s a delicate balancing act that can induce stress and anxiety, particularly for those living paycheck to paycheck. Adding another layer to this struggle are complex dynamics within families when it comes to money matters.

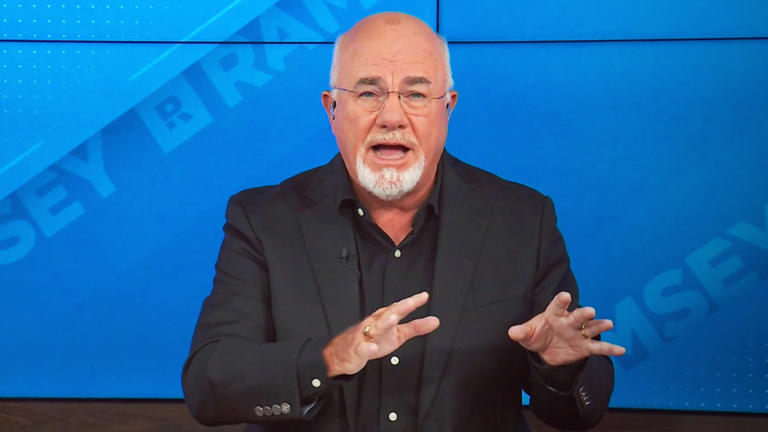

Dave Ramsey, a well-known personal finance author and radio host, frequently addresses these issues, recognizing the intricate web of personal relationships that intertwine with financial concerns. Ramsey often emphasizes the importance of clear communication and setting boundaries, especially when family dynamics intersect with financial decisions.

In a recent exchange, Ramsey fielded a dilemma from a listener named Ronald. Ronald, one of four brothers, reached out to Ramsey seeking advice on a challenging situation. His two oldest brothers had unilaterally decided to organize an elaborate celebration for their parents’ fiftieth wedding anniversary without consulting Ronald or their other brother. Moreover, they expected each sibling to contribute $1,000 towards the event.

Ronald, who was actively working to regain control of his finances and eliminate debt, felt conflicted about his financial obligation to the family celebration. He expressed his concerns to Ramsey, explaining that his emergency savings fund consisted of only $1,000. Despite his love for his parents, Ronald was unsure how to navigate the financial pressure imposed by his siblings.

In response, Ramsey provided straightforward advice, urging Ronald not to feel obligated to contribute to the costly celebration. He asserted that since Ronald and his other brother were not consulted about the plans, it was fair for them to decline financial participation. Ramsey emphasized that fair consideration and clear communication were paramount, rather than financial capability or familial love.

Furthermore, Ramsey advised Ronald to have an open and honest conversation with his older brothers, articulating his financial situation and his commitment to financial responsibility. He encouraged Ronald to explain that while he would contribute what he could afford, it would not amount to $1,000.

Ramsey also underscored the need for Ronald to assert boundaries and not allow his older brothers to guilt-trip him into compliance. He emphasized that Ronald’s decision was not driven by greed or lack of affection for his parents but was a prudent financial choice given the circumstances.

Moreover, Ramsey recommended that Ronald advise his brothers to consult with all family members in advance for any future expensive plans. By doing so, Ramsey believed that Ronald could not only address the current issue but also prevent similar situations from arising in the future.

In navigating this financial dilemma, Ramsey’s guidance emphasized the importance of prioritizing financial health and maintaining clear communication within familial relationships. By setting boundaries and making decisions based on financial prudence rather than external pressure, individuals like Ronald can navigate complex family dynamics while safeguarding their long-term financial well-being.