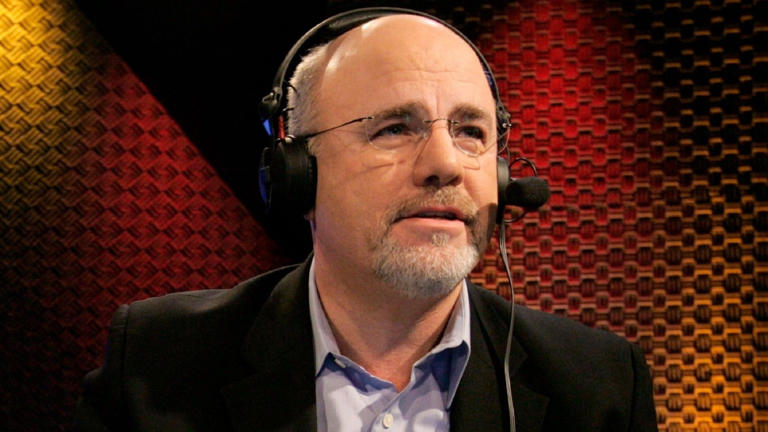

Dave Ramsey, a renowned financial expert and host, recently shared valuable insights into wealth-building strategies, particularly emphasizing the importance of managing depreciating assets in relation to one’s income. Ramsey’s advice serves as a practical guide for individuals seeking to make prudent financial decisions and achieve long-term financial stability.

According to Ramsey, it’s crucial not to overextend oneself by tying a significant portion of wealth to assets that depreciate rapidly, such as cars, trucks, boats, motorcycles, and other vehicles. He suggests a rule of thumb: the total value of all vehicles owned should not exceed half of one’s annual income. This guideline helps individuals avoid overexposure to assets that diminish in value over time, thereby safeguarding their financial health.

Ramsey’s rationale for this advice is grounded in the principle of prioritizing investments with potential for appreciation over those that depreciate. By limiting the value of depreciating assets relative to income, individuals can allocate resources more effectively toward wealth-building opportunities, such as investments in appreciating assets like stocks, real estate, or retirement accounts.

Moreover, Ramsey recommends adopting a cash-only approach to vehicle purchases, advocating for financial prudence and avoiding unnecessary debt. By paying for vehicles in cash, individuals can steer clear of costly interest payments and maintain greater control over their financial well-being.

In addition to setting limits on vehicle values, Ramsey advises individuals to regularly reassess their asset allocation and divest from assets that exceed predetermined thresholds. For instance, if a car’s value surpasses 50% of one’s annual income, Ramsey suggests considering selling the vehicle to reallocate funds toward more productive uses.

Overall, Ramsey’s advice underscores the importance of aligning spending habits with long-term financial goals and prioritizing investments that contribute to wealth accumulation. By avoiding excessive spending on depreciating assets and focusing on prudent financial management, individuals can position themselves for greater financial security and success in the future.