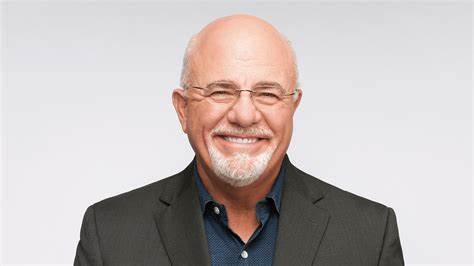

Dave Ramsey, a leading proponent of debt-free living, recently engaged with Aaron from Richmond, Virginia, during a call on his show, where they discussed Aaron’s financial concerns. Aaron and his wife, deeply committed to Ramsey’s Baby Step two — eliminating all debt — were grappling with a challenging decision regarding their 401(k) contributions in light of an unexpected tax bill.

With a household income of $131,000, Aaron disclosed that they were currently contributing $6,000 annually to their 401(k), including a 6% employer match. However, the sudden tax liability had raised concerns about their ability to maintain these contributions while also addressing their outstanding debt.

In response, Ramsey offered his perspective, emphasizing the paramount importance of prioritizing debt repayment over the allure of tax deferrals or employer matches in retirement accounts. Despite the potential benefits of these contributions, Ramsey urged Aaron to focus on eliminating their existing debts first and foremost. Given Aaron’s total debt load of $120,000, which included credit card debt, student loans, and vehicle loans, Ramsey advised redirecting their resources towards debt reduction, even if it meant temporarily forgoing the employer match.

Ramsey’s stance is rooted in the principle of focus, advocating for a laser-like concentration on debt eradication to achieve financial freedom. He stressed the need for lifestyle adjustments and addressing overspending habits, rather than becoming distracted by relatively minor tax benefits or employer matches.

However, Ramsey’s advice has sparked debate among financial experts, some of whom argue against the wisdom of pausing 401(k) contributions, especially when faced with high-interest debt. They contend that the returns from employer matches in 401(k) plans often surpass the interest rates on most debts, making it financially advantageous to secure the full match before aggressively tackling debts.

Similarly, proponents of maximizing employer matches highlight the 401(k) match as a guaranteed return on investment, suggesting that it can provide significant financial benefits, particularly in a low-interest environment.

Both perspectives underscore the importance of a balanced financial strategy tailored to individual circumstances and goals. While Ramsey prioritizes debt elimination as a cornerstone of financial stability, others advocate for leveraging employer matches to bolster long-term financial security.

Ultimately, the decision to pause 401(k) contributions while in debt hinges on various factors, including the interest rates on existing debts, individual risk tolerance, and long-term financial objectives. It’s crucial for individuals like Aaron to carefully weigh the potential benefits and drawbacks of each approach and seek personalized financial advice to determine the most suitable course of action for their unique circumstances.