Dan Niles, a notable figure in the tech investment sphere and the founder of Niles Investment Management, recently made a bold assertion regarding the future trajectory of Nvidia Corp. (NASDAQ: NVDA), suggesting that the company could be on the brink of significant growth that might even surpass that of Apple Inc. (NASDAQ: AAPL).

During a segment on CNBC’s “Last Call,” Niles offered insights into the comparative revenue performance of Nvidia and Apple over various time frames, asserting that Apple has notably underperformed in this regard. He underscored Nvidia’s potential for continued growth, particularly in contrast to Apple, whose primary focus lies within the smartphone industry—an arena Niles views as somewhat stagnant in terms of growth opportunities.

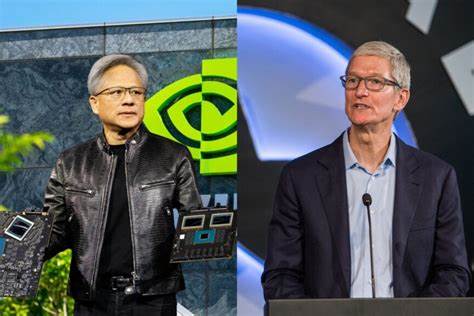

Niles drew attention to Nvidia’s strengths in innovation, particularly in emerging technologies such as artificial intelligence (AI), where the company has demonstrated considerable prowess. In contrast, he suggested that Apple, under the leadership of Tim Cook, has struggled to maintain a comparable level of innovation, particularly in comparison to other smartphone manufacturers leveraging AI technology to drive advancements.

In light of these observations, Niles expressed a clear preference for Nvidia over Apple as a long-term investment, citing Nvidia’s potential for sustained growth and innovation.

Niles’ remarks coincide with a significant milestone for Nvidia, as the company recently achieved a market capitalization of $3 trillion, making it only the third company to reach this landmark valuation. This achievement underscores the remarkable growth trajectory of Nvidia and positions it as a formidable player in the tech industry.

Despite initial skepticism, Nvidia’s market capitalization continues to soar, driven by its strong performance in key areas such as AI and innovation. This growth has propelled Nvidia to the position of the second most valuable company globally, surpassing Apple in market capitalization.

In response to Niles’ comments, Nvidia shares surged by 5.16% on Wednesday, reaching a record high of $1,224.40. Meanwhile, Apple shares experienced a more modest uptick of 0.78%.

Niles’ prediction and the subsequent market response reflect growing optimism surrounding Nvidia’s future prospects and its potential to outshine other tech giants like Apple in the years to come. As Nvidia continues to innovate and expand its footprint in the tech industry, investors are increasingly bullish on the company’s growth potential and market dominance.