Chinese auto sales experienced a significant downturn in June, reflecting broader economic challenges within the country. The China Association of Automobile Manufacturers (CAAM) reported that sales in China fell by 7.4% year-over-year to 1.8 million cars. This decline underscores ongoing economic sluggishness and a notable decrease in consumer confidence. Despite the domestic sales slump, the overall impact on the Chinese auto industry was mitigated by a substantial increase in exports, highlighting a complex and multifaceted market scenario.

The decline in domestic sales marks the second consecutive monthly downturn. Separate data from the China Passenger Car Association indicates that this trend extends over three months of falling sales. Several factors contribute to this domestic downturn, including a severe real estate slump. The slump has significantly hindered economic growth and dampened consumer confidence, leading to reduced spending on big-ticket items like cars. Additionally, there is a noticeable shift in consumer preferences towards electric vehicles (EVs) and hybrids, which has affected the sales of traditional gasoline-powered cars.

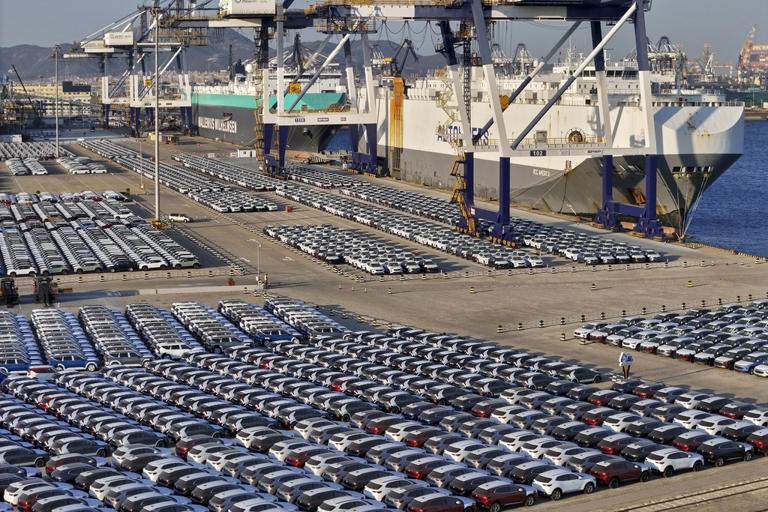

While domestic sales have faltered, exports have surged, providing a buoyant counterbalance. In June, exports rose by 29% year-over-year to 400,000 units. For the first half of the year, exports increased by 31.5%, while domestic sales saw a modest rise of only 1.6%. This robust export growth underscores the global demand for Chinese vehicles, particularly in markets where local automakers have withdrawn due to geopolitical issues. Russia has emerged as the largest and fastest-growing export market for Chinese automakers, filling the void left by the withdrawal of Western automakers following the Russian invasion of Ukraine. Other significant export markets include Brazil and Mexico in Latin America, the United Arab Emirates and Saudi Arabia in the Middle East, and Belgium and the United Kingdom in Europe.

The substantial increase in exports has sparked concerns in Europe and the United States about the competitive threat posed by inexpensive China-made cars. Although much attention has focused on China’s flashy and moderately priced electric vehicles, the majority of export growth has been in gasoline-powered vehicles. These vehicles saw a 36% increase in the first half of the year and constituted 78% of total vehicle exports. In contrast, Chinese EV exports decreased by 2.3%, while hybrid vehicle exports surged by 180% from a smaller base. The growing export market for gasoline vehicles has helped offset weaker sales in China, where the overall market has stagnated and buyers have increasingly shifted towards electric vehicles and hybrids.

The robust export performance has not been without its challenges. The European Union recently imposed provisional duties on Chinese electric vehicles, arguing that government subsidies provide Chinese automakers with an unfair advantage. This regulatory hurdle highlights the growing trade tensions and competitive dynamics in the global auto market. In response to these challenges, Chinese automakers are increasingly investing in overseas production to mitigate the impact of trade barriers and tap into new markets. BYD, China’s largest EV maker, exemplifies this strategy. The company recently opened a plant in Thailand and plans to establish factories in Brazil, Hungary, and Turkey. These moves are aimed at mitigating the impact of trade barriers and tapping into new markets.

The mixed performance of the Chinese auto industry in June reflects broader economic trends and strategic shifts. While domestic sales have suffered due to economic uncertainties, the industry has capitalized on strong export growth to maintain its momentum. The ongoing expansion into international markets and the response to regulatory challenges will be crucial in shaping the future trajectory of Chinese automakers on the global stage. The interplay between domestic challenges and international opportunities highlights the complexity and dynamism of the Chinese auto industry in the current economic landscape.