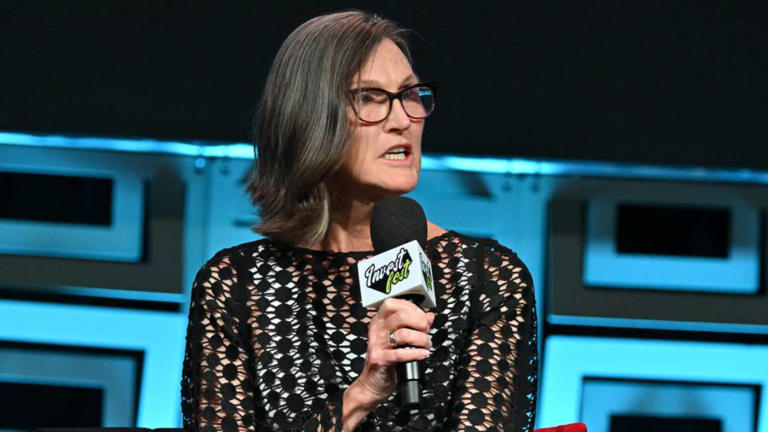

Cathie Wood, the renowned head of Ark Investment Management, is known for her dynamic and often controversial investment strategy. Her recent actions underscore her commitment to her investment philosophy, which emphasizes bold moves in the high-growth tech sector. Last Friday, Wood made headlines by capitalizing on a dip in CrowdStrike’s stock, reflecting her characteristic approach to managing her portfolio amidst market fluctuations.

Cathie Wood’s Investment Philosophy

Cathie Wood, affectionately known as “Mama Cathie” by her supporters, has achieved significant recognition in the investment world, particularly after a remarkable 153% return in 2020. Wood’s investment strategy is centered around identifying and investing in emerging technologies and high-growth sectors. Her flagship fund, the Ark Innovation ETF (ARKK), focuses on disruptive innovations such as artificial intelligence, blockchain, DNA sequencing, energy storage, and robotics. Wood believes these sectors have the potential to drive transformative changes across various industries, offering substantial long-term gains.

Despite her impressive past performance, Wood’s investment approach has been a subject of considerable debate. Her funds often invest in young, high-risk companies with high growth potential but also significant volatility. This strategy has led to dramatic fluctuations in the value of her investments, and her funds have faced criticism for their inconsistent performance over longer periods.

Performance and Criticism

The performance of Ark Innovation ETF (ARKK) has been under scrutiny, particularly in the context of its long-term returns. The ETF, which manages approximately $6.4 billion in assets, has experienced negative annualized returns of 7.94% over the past year, 26.26% over the past three years, and a minimal 0.06% over five years. These figures starkly contrast with the performance of the S&P 500 index, which has delivered annualized returns of 22.4% over one year, 10.65% over three years, and 14.95% over five years. This divergence highlights the volatility and risk associated with investing in disruptive technologies.

Morningstar analyst Robby Greengold has been critical of Wood’s investment approach, arguing that the firm lacks the forecasting talent required to navigate the risks associated with emerging technologies effectively. Greengold suggests that while the potential of Wood’s high-tech platforms is compelling, the firm’s ability to manage and capitalize on these opportunities has been inconsistent. This critique reflects a broader debate about the merits of investing in high-growth, high-risk sectors versus more stable, traditional investments.

Wood has defended her investment philosophy, asserting that traditional investment metrics and models do not adequately capture the potential of disruptive technologies. She argues that her strategy reflects a forward-looking perspective that challenges conventional investment paradigms. Wood believes that as technology continues to evolve, it will blur the lines between sectors, making traditional investment “style boxes” obsolete.

Recent Investment Moves

Wood’s recent investment decisions offer insight into her strategy of capitalizing on market opportunities. On July 19, Ark funds purchased 38,595 shares of CrowdStrike (CRWD), a cybersecurity firm, valued at $11.8 million based on that day’s closing price. This decision followed a significant drop in CrowdStrike’s stock price, which fell by 23% due to a software update that caused a global IT outage. Despite the drop, Wood saw this as a buying opportunity, interpreting the decline as an overreaction and a chance to acquire shares at a lower price. Morningstar analyst Malik Ahmed Khan supported this view, noting that the market’s reaction was overly punitive given that the software update did not represent a breach of CrowdStrike’s security capabilities.

At the same time, Ark funds sold shares of Tesla (TSLA) on consecutive trading sessions. On Friday, Ark funds unloaded 17,607 shares of Tesla, valued at $4.2 million, following an earlier sale of $8 million worth of Tesla stock. Tesla’s stock had surged 71% over the past three months despite some negative news surrounding the company. Wood’s decision to sell reflects her strategy of adjusting her portfolio based on current market conditions and perceived opportunities.

Conclusion

Cathie Wood’s investment strategy remains a subject of intense discussion and scrutiny within the financial community. Her recent actions, including the purchase of CrowdStrike and the sale of Tesla, illustrate her willingness to make bold moves in response to market dynamics. While her approach has been criticized for its volatility and inconsistent long-term performance, it also reflects a broader trend towards investing in high-growth, disruptive technologies. Wood’s ability to navigate these investments continues to attract both support and criticism, underscoring the ongoing debate about the future of investment strategies in an evolving market landscape.