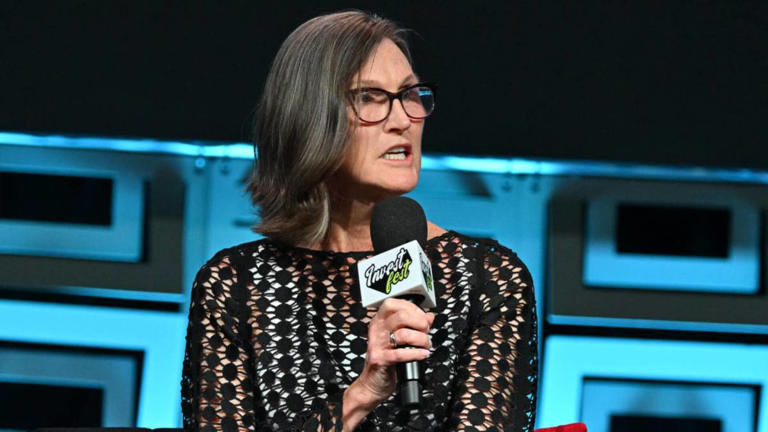

Cathie Wood, the renowned head of Ark Investment Management, has emerged as a prominent figure in the world of money management in recent years.

Often referred to affectionately by her followers as “Mama Cathie,” Wood gained widespread recognition due to her remarkable performance, notably achieving a staggering 153% return in 2020. Her clear articulation of her investment philosophy through numerous media appearances further solidified her reputation.

However, despite her impressive short-term performance, Wood’s longer-term track record tells a different story. While her flagship Ark Innovation ETF (ARKK), boasting $7.8 billion in assets, has delivered a respectable 31% return over the past 12 months, its annualized returns over the past three and five years are notably less impressive, standing at negative 25% and a modest positive 2%, respectively.

In comparison, the S&P 500 index has outperformed Wood’s fund, delivering positive returns of 34% over one year, 12% over three years, and 15% over five years. Notably, Wood has set a target of achieving at least 15% annual returns over five-year periods, a goal that her fund has yet to consistently meet.

Cathie Wood’s Investment Philosophy

Cathie Wood’s investment strategy revolves around targeting young, high-growth companies operating in innovative sectors such as artificial intelligence, blockchain, DNA sequencing, energy storage, and robotics. She sees these areas as transformative for the global economy. However, the stocks within these sectors are known for their volatility, leading to rollercoaster rides for Ark’s ETFs. Wood also frequently adjusts her portfolio holdings by trading in and out of her top positions.

Morningstar, a prominent investment research firm, has been critical of Wood and the Ark Innovation ETF. Analyst Robby Greengold expressed skepticism about Ark’s ability to navigate the challenging terrain of high-growth technology stocks. While acknowledging the potential of the sectors Wood targets, Greengold questioned Ark’s capacity to identify winning investments and manage the associated risks effectively. He highlighted the fund’s history of middling returns and extreme volatility since its inception in 2014.

Morningstar’s assessment characterizes Ark’s investment approach as unconventional, focusing on stocks with minimal current earnings, high valuations, and closely correlated prices. The extreme volatility of these stocks reflects their uncertain futures, according to Greengold.

In response to Morningstar’s criticism, Wood defended her strategy, suggesting that traditional investment frameworks like Morningstar’s “style boxes” are becoming outdated in the face of technological disruption. She emphasized that Ark’s approach defies easy categorization and is driven by a deep understanding of disruptive innovation.

Despite Wood’s rebuttal, some investors seem to share Morningstar’s concerns. Despite Ark Innovation ETF’s recent rally, it experienced a net outflow of $1.9 billion over the past 12 months, indicating a degree of skepticism among investors regarding the fund’s performance and strategy.

Cathie Wood’s trades this week

Ark Investment Management made several notable moves in its portfolio during the week. Firstly, it sold 779,972 shares of Twilio (TWLO), a cloud-based communications platform, with the value of this transaction totaling $48.3 million as of Wednesday’s close. Twilio’s stock had declined by 14% since February 14, following an earnings report that fell short of expectations. Cathie Wood may have opted to reduce the fund’s exposure to Twilio to mitigate potential further losses.

Conversely, Ark funds purchased 249,420 shares of Moderna (MRNA), a biotechnology company renowned for its COVID-19 vaccine. These acquisitions amounted to a combined $25.7 million as of Wednesday’s close. Moderna’s stock has faced a 32% drop over the past year due to declining revenue from COVID-19 vaccines. However, Wood might view this as an opportunity to invest, especially considering Morningstar analyst Karen Andersen’s bullish stance, with a fair value assessment for Moderna stock at $227.

Additionally, Ark funds divested 162,704 shares of Block (SQ), formerly known as Square, a financial payments company that operates Cash App. The value of this sale was $13.3 million as of Wednesday’s close. Block’s stock has surged by over 100% since October 30, fueled by robust earnings reports. Wood may have opted to capitalize on these gains by selling shares of Block and locking in profits.