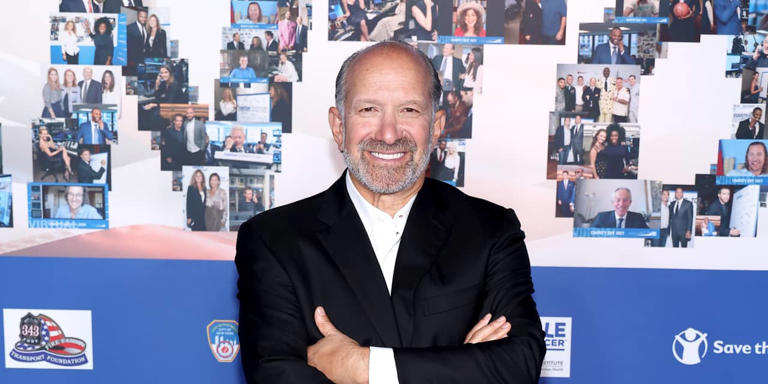

Howard Lutnick, the CEO of Cantor Fitzgerald, offered a comprehensive analysis of the Federal Reserve’s recent policy decisions and their potential implications for the financial markets. Speaking on CNBC’s “Closing Bell Overtime,” Lutnick provided insights into the Fed’s stance on interest rates amid mounting concerns about inflationary pressures exceeding the central bank’s target range.

In the interview, Lutnick emphasized that the Fed’s latest move signaled a clear commitment to maintaining interest rates within a stable range, at least until the summer months. Despite the Fed keeping its policy rate steady within the 5.25% to 5.5% range, it announced plans to adjust the pace of balance sheet reduction, starting in June. Specifically, the Fed intends to reduce the monthly cap for Treasury securities roll-off from $60 billion to $25 billion, reflecting a more gradual approach to monetary tightening.

The decision to slow down balance sheet reduction is significant, according to Lutnick, as it indicates a subtle shift in the Fed’s policy stance towards greater accommodation. While the Fed stopped short of implementing rate cuts, its adjustment to balance sheet reduction suggests a nuanced approach to supporting economic growth amidst ongoing challenges.

Lutnick also raised concerns about the potential impact of higher interest rates on the commercial real estate market, drawing attention to projections from Cantor’s affiliate property-market firm, Newmark. With a substantial portion of commercial mortgages facing maturity in the coming years, there is growing apprehension about the implications for market stability. Lutnick warned of a looming wave of defaults, particularly as a significant number of these mortgages are underwater, posing risks to financial institutions and exacerbating market volatility.

The response in the bond market following the Fed’s announcement was notable, with the 10-year Treasury yield easing by 5 basis points to 4.63% on Wednesday. However, the yield remained significantly higher than its 2024 low, reflecting persistent concerns about inflationary pressures and the potential for tighter monetary policy.

In summary, Lutnick’s analysis underscores the complex interplay between monetary policy decisions, market dynamics, and economic fundamentals. As investors navigate through an uncertain landscape, understanding the implications of the Fed’s actions and communication becomes paramount in shaping investment strategies and managing risks in the financial markets.