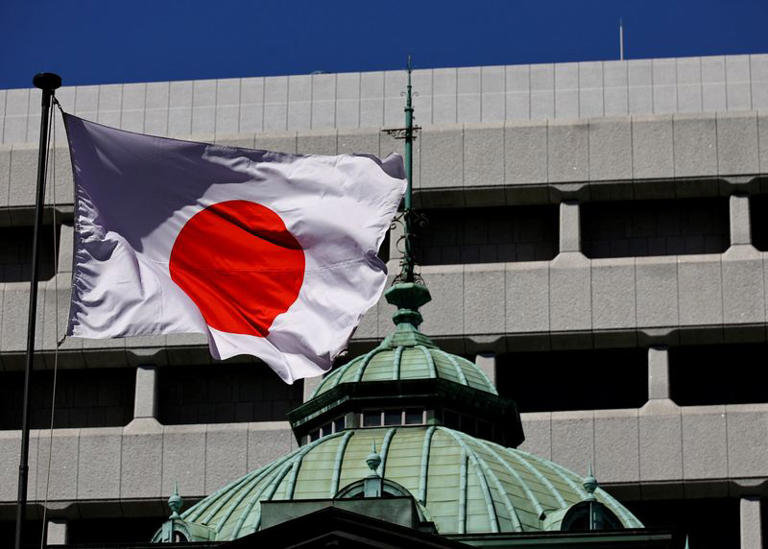

The Bank of Japan (BOJ) has recently announced its intention to host a workshop next month, serving as the culmination of an extensive year-long review process. This review aims to critically assess the effectiveness and potential consequences of the unconventional monetary easing tools that the central bank has utilized over the past 25 years in its ongoing battle against deflationary pressures.

Scheduled to take place on May 21, the workshop will gather a diverse array of participants, including central bank officials, esteemed academics, and prominent private economists. Together, they will engage in comprehensive discussions surrounding various facets of economic and price trends, as well as the evolution of monetary policy strategies employed by the BOJ during the aforementioned period.

This initiative was set into motion following the assumption of office by Kazuo Ueda as the BOJ Governor in April of the previous year. At that time, Ueda underscored the imperative need to meticulously scrutinize both the intended impacts and potential side effects stemming from the radical stimulus measures that the central bank has implemented throughout its protracted struggle against deflation.

While the BOJ has clarified that the outcomes of this review will not wield immediate influence over its forthcoming policy decisions, it has nevertheless emphasized the critical importance of this exercise. Specifically, the review aims to elucidate which unconventional monetary tools have proven most effective and under what circumstances, thereby offering invaluable insights to inform future policy adjustments.

The recent decision by the BOJ to terminate eight years of negative interest rates and other unconventional policy measures signifies a pivotal juncture in the central bank’s approach to monetary policy. This marked departure from its longstanding reliance on massive monetary stimulus to spur economic growth represents a significant paradigm shift.

Analysts attribute the prolonged and persistent challenge of deflation in Japan as a driving force behind the BOJ’s strategic deliberations regarding the transition away from ultra-loose monetary policy. The ongoing review process is widely regarded as an instrumental step in distilling the key lessons gleaned from Japan’s protracted struggle with deflation. Ultimately, it aims to furnish policymakers with valuable insights to guide future monetary policy decisions in response to evolving economic conditions and challenges.