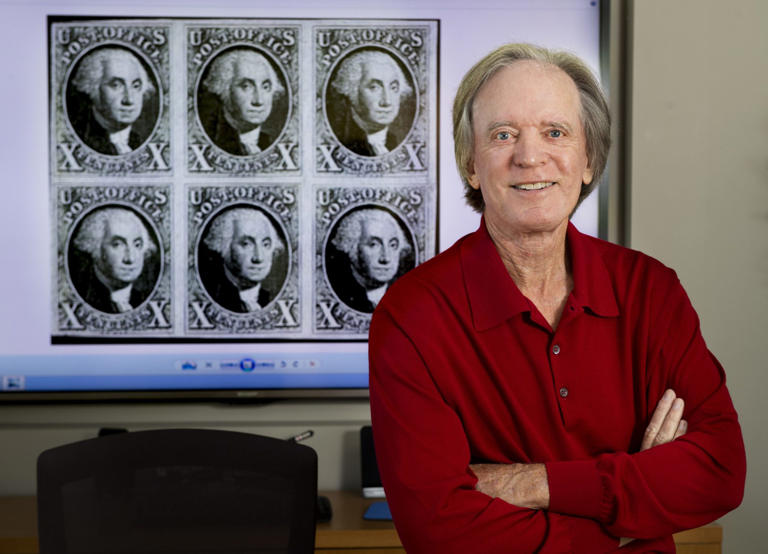

Bill Gross, a luminary in the realm of bond investing, has meticulously assembled what is arguably the most comprehensive collection of rare U.S. stamps, poised to make history as it heads to auction. Scheduled for sale by the esteemed Robert A. Siegel auction house over Friday and Saturday, each individual stamp from Gross’s collection is expected to fetch a remarkable sum, with market estimates reaching an astounding $15 million to $20 million. Should these projections materialize, it would signify an unprecedented pinnacle in the annals of U.S. stamp auctions.

At the heart of Gross’s collection lies a true gem: an 1868 “Z Grill” stamp, valued at just one cent. This particular philatelic marvel is anticipated to command a staggering price tag of $4 million to $5 million, potentially shattering existing records for U.S. stamp sales.

In a promotional video heralding the upcoming auction, the Siegel auction house exuded confidence, suggesting that Gross’s collection possesses the transformative power to elevate the stature of stamp collecting to unprecedented heights.

Despite the anticipation of record-breaking sales, Gross remains circumspect about the future trajectory of the stamp market. He harbors concerns of an impending correction and has accordingly opted to divest a portion of his holdings. Gross attributes this shift in market dynamics to the diminishing interest among younger generations, noting a decline in the traditional base of youthful collectors over time.

In recent years, Gross has systematically liquidated a significant portion of his stamp portfolio, tallying approximately $50 million in sales. Notably, one of his prior auctions, featuring a collection of U.K. postage, also achieved record-breaking results, underscoring the enduring allure of philatelic treasures.

While steering away from stamp collecting, Gross remains an active presence in the financial sphere, disseminating insights on market trends through various mediums, including interviews, newsletters, and social media platforms. In a recent interview, he opined on the potential ramifications of a reelection bid by Donald Trump, cautioning that such an outcome could spell greater turbulence for the bond market compared to a victory by Joe Biden. Citing Trump’s advocacy for tax cuts and increased spending, Gross articulated concerns over the disruptive forces that could accompany another term in office for the incumbent president.