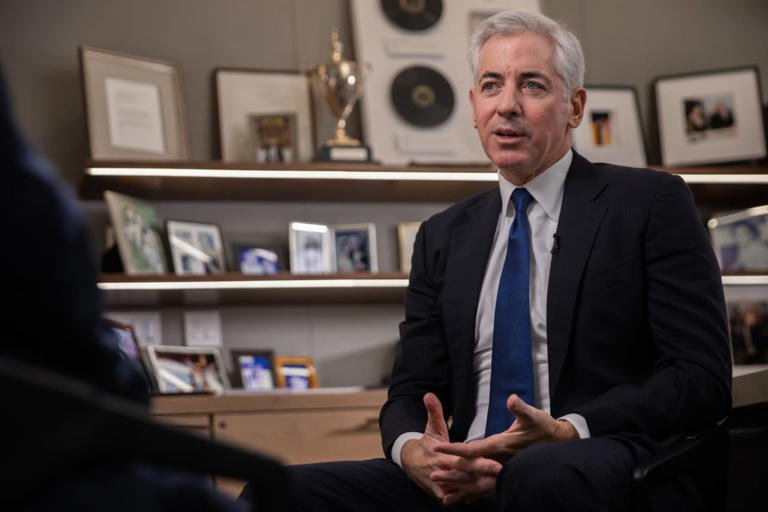

Bill Ackman, a prominent figure in the investment world, renowned for his high-profile ventures, is now embarking on a new endeavor designed to capitalize on his celebrity status and attract substantial investment. At 58 years old, Ackman is spearheading the launch of Pershing Square USA (ticker: PSUS), an equity-oriented closed-end fund slated for listing on the New York Stock Exchange. His ambitious goal? To raise an impressive $25 billion in capital by the end of July. While this target is bold, its realization hinges on investor demand, which remains uncertain at this juncture.

Despite proposing a steep 2% annual management fee—significantly higher than the industry standard of 1% or less—Ackman is betting on his reputation and track record to justify this fee structure. To sweeten the deal, Pershing Square Capital Management, Ackman’s Manhattan-based management company, intends to waive the management fee for the first year and infuse $500 million of its own capital into the fund.

Ackman’s recent successes, particularly with Pershing Square Holdings, have bolstered his standing in the investment community. While he faced challenges from 2015 to 2017, including significant losses on investments such as Valeant Pharmaceuticals, Pershing Square Holdings has since delivered impressive returns, outperforming the S&P 500 with a remarkable 28% annual return over the past five years.

The proposed investment strategy for Pershing Square USA entails a concentrated approach, focusing on 12 to 20 “durable North American growth companies.” This strategic shift aligns with Ackman’s evolving investment style, which has pivoted away from activism and shorting, towards longer-term investments in quality companies.

Although there may be some overlap in holdings between Pershing Square USA and Pershing Square Holdings—given the latter’s top positions in companies like Chipotle Mexican Grill and Alphabet—Ackman sees ample opportunities in the current market landscape, dominated by large-cap growth companies.

However, the new fund may face competition from Pershing Square Holdings, which currently trades at a discount to its net asset value (NAV). This discount, estimated at around 25%, could initially make Pershing Square Holdings a more appealing option for investors.

Despite potential challenges, Ackman’s recent sale of a 10% stake in Pershing Square Capital Management for $1.05 billion has significantly boosted his personal wealth, estimated at over $7 billion. This sale, coupled with the anticipated IPO of Pershing Square Capital Management in 2025, underscores Ackman’s confidence in his ability to attract capital and generate returns for investors.

Nevertheless, the success of Ackman’s new fund hinges on its ability to resonate with investors in a challenging market environment. With his past successes and celebrity status, Ackman remains optimistic about his latest endeavor, poised to defy expectations once again.