It seems like there’s a shift happening in the stock market landscape. The recent strength in the U.S. economy is encouraging investors to look beyond the tech giants like Apple and Tesla that have traditionally driven market gains. Instead, they’re diversifying into a broader range of stocks, which has helped push the equal-weighted S&P 500 to a record high. This shift suggests that investors are becoming more optimistic about the overall health of the economy, even as interest rates have risen.

With inflation showing signs of easing and the Federal Reserve appearing less hawkish, investors are feeling more confident about taking on riskier assets. This broader rally is seen as a positive development because it reduces concerns about overreliance on big tech companies and the potential vulnerability of the stock market to a reversal.

Joseph Amato from Neuberger Berman highlighted that the improving economic conditions and a more accommodative Fed stance make a compelling case for investing in riskier assets over the long term.

Looking ahead, investors will be closely watching the latest consumer-price index reading for insights into inflation trends. Additionally, earnings reports from companies like Oracle, Kohl’s, and Adobe will provide further guidance on the health of the corporate sector.

The recent dynamics in the stock market reveal a nuanced picture. While rising borrowing costs and expectations of a slowdown previously concentrated stock gains, there’s now a shift in momentum. Tech giants like Nvidia and Microsoft, part of the “Magnificent Seven,” have maintained profitability despite economic challenges, thanks to their cash reserves and prudent debt management during the pandemic.

Corporate profits are projected to benefit from robust productivity and government spending initiatives. Although the Federal Reserve initially forecasted modest economic growth for this year, recent data suggests a more optimistic outlook, with the economy potentially growing at a higher rate.

Tech stocks continue to perform well, while rate-sensitive sectors like utilities and real estate have remained relatively stable. Industrial and financial services sectors, closely tied to growth prospects, have seen gains of at least 7%. Additionally, small-cap stocks, previously hit hard by concerns over borrowing costs, have rebounded significantly.

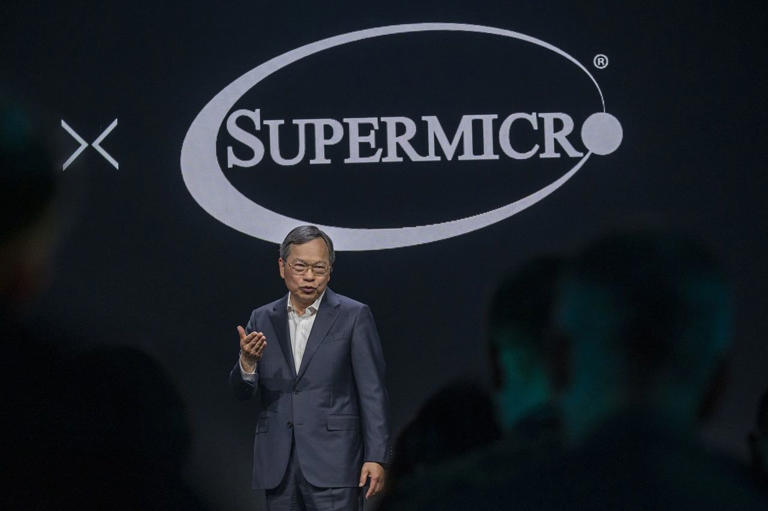

Among small-cap companies, those capitalizing on investor enthusiasm, such as Super Micro Computer and MicroStrategy, have seen substantial gains. However, the surge in speculative investments raises some cautionary flags for investors.

Valuation metrics indicate that stocks may be trading above historical averages, suggesting potential overvaluation. Furthermore, meeting analysts’ earnings expectations could prove challenging, especially if economic growth slows more than anticipated.

Some market observers, like Jawad Mian, anticipate a shift in market dynamics, with smaller companies potentially outperforming as the dominance of Big Tech wanes.

Investors are also keeping a watchful eye on inflation trends. Concerns about a possible resurgence in inflation, particularly after recent CPI data showed unexpected increases, could influence the trajectory of interest rates and market sentiment going forward. If inflation remains elevated and economic growth stays strong, interest rates might stay higher for longer than expected, impacting market dynamics.

The impending need for refinancing has been a challenge for smaller stocks, particularly those in the Russell 2000 index. These companies often carry higher leverage, meaning their debt levels relative to cash reserves or earnings are elevated. Additionally, a significant portion of the Russell 2000, excluding financial firms, holds floating-rate debt like bank loans, which can increase vulnerability to rising interest rates. This contrasts sharply with the S&P 500, where only a fraction of companies have such debt structures.

As Joseph Amato from Neuberger Berman highlighted, the assumption that inflation had been tamed has been challenged, and higher rates are expected to impact companies beyond large-caps with strong balance sheets.

Randy Gwirtzman of Baron Capital emphasizes the importance of avoiding heavily leveraged companies in his investment strategy. Instead, he sees potential in smaller companies like DraftKings, especially during economic upturns.

The current market environment, characterized by investor preference for Big Tech stocks, has somewhat overshadowed smaller companies. However, Gwirtzman believes that economic upswings present unique opportunities for smaller firms, indicating a potential shift in sentiment towards these companies.