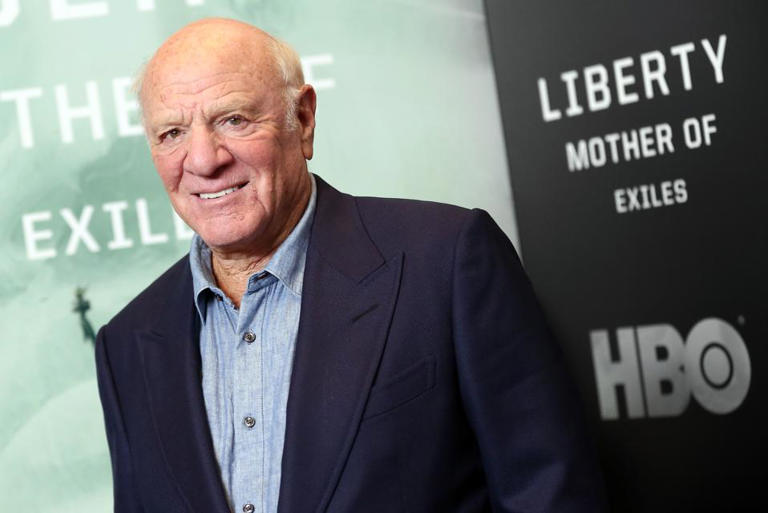

Billionaire media mogul Barry Diller, who boasts an estimated net worth of $4.1 billion, is currently in discussions with National Amusements, the parent company of Paramount, in an attempt to gain control of the entertainment conglomerate. This development, first reported by The New York Times, marks the latest chapter in a series of high-stakes negotiations and strategic maneuvers surrounding Paramount. Diller’s interest follows the recent collapse of merger talks between Paramount and Skydance Media, which had been the most promising bid to date.

Background and Context

Barry Diller’s career in media spans several decades and includes significant achievements and acquisitions. Diller, 82, has been a prominent figure in the industry, known for his strategic acumen and ability to foresee and shape media trends. He is the chairman and senior executive of IAC/InterActiveCorp, a media and internet conglomerate that owns brands such as Vimeo, Dotdash Meredith, and Care.com. His estimated net worth places him among the top 800 wealthiest individuals globally.

Diller’s history with Paramount dates back to the 1990s when he made a $9.5 billion bid to acquire the company. However, he was outbid by Sumner Redstone, whose aggressive acquisition strategy led to his control of Paramount through National Amusements. Today, Sumner Redstone’s daughter, Shari Redstone, serves as the controlling shareholder, continuing the family’s legacy in the media empire.

The Current Negotiations

The latest negotiations between Diller and National Amusements involve Diller’s company, InterActiveCorp (IAC), signing nondisclosure agreements (NDAs) with National Amusements. These agreements, reported by The New York Times, are crucial as they enable the exchange of confidential information necessary for evaluating the potential deal. The NDAs were signed after the failure of the merger talks between Paramount and Skydance in mid-June. The discussions’ specifics and the progress made remain undisclosed, maintaining a veil of secrecy typical in high-stakes corporate negotiations.

Strategic Importance and Implications

Acquiring control of Paramount would be a significant coup for Diller and IAC. National Amusements owns 77% of Paramount’s class A shares, meaning that gaining control of National Amusements would effectively grant Diller control of Paramount without the need for a full acquisition. This strategic move could position Diller to influence one of the oldest and most storied entertainment companies in the industry.

However, any potential deal comes with substantial financial implications. Paramount is saddled with $14 billion in debt, a considerable burden that would be passed on to the buyer. This debt load is a critical factor for any potential acquirer to consider, as it would significantly impact the financial health and strategic options available post-acquisition.

Historical Context and Competitive Landscape

Diller’s renewed interest in Paramount is not an isolated incident but part of a broader trend of consolidation and strategic repositioning within the media and entertainment industry. Over the past few years, major media companies have sought to merge, acquire, or be acquired to better compete in an environment increasingly dominated by streaming giants like Netflix, Amazon Prime, and Disney+.

Earlier this year, Skydance Media came close to merging with National Amusements in a deal valued at approximately $1.7 billion. This proposed merger, which ultimately fell through in mid-June, was one of the most serious bids for Paramount in recent years. Skydance, known for its production of high-grossing films and partnerships with major studios, was seen as a potential strong partner for Paramount, but the merger’s collapse left the door open for other suitors.

In addition to Skydance, Sony and Apollo Management also expressed interest in acquiring Paramount. Sony and Apollo’s bid was notably higher, with a $26 billion all-cash offer. However, this offer has faced internal reconsideration at Sony due to concerns raised by investors. The competitive landscape underscores the high value and strategic importance of Paramount within the media industry, making it a prime target for acquisition.

Challenges and Considerations

Despite the allure of acquiring Paramount, there are significant challenges and considerations for any potential buyer. Paramount’s substantial debt is a major hurdle. Managing and servicing this debt while attempting to steer the company towards growth and profitability would require a robust financial strategy and operational excellence.

Furthermore, the media landscape is undergoing rapid transformation. Traditional media companies like Paramount are grappling with the shift from linear television to digital and streaming platforms. Competing with established streaming giants requires substantial investment in content creation, technology, and marketing. A new owner would need to navigate these challenges while leveraging Paramount’s rich legacy and brand recognition.

Future Prospects and Strategic Vision

For Barry Diller, acquiring control of Paramount could represent a culmination of his long-standing ambition to shape the media industry. His strategic vision for Paramount would likely involve leveraging IAC’s digital expertise to enhance Paramount’s position in the streaming market. Integrating Paramount’s extensive content library with innovative digital strategies could create new revenue streams and strengthen its competitive position.

Moreover, Diller’s track record of identifying and capitalizing on emerging trends could be beneficial for Paramount. His leadership could drive strategic initiatives aimed at expanding Paramount’s global reach, enhancing its content portfolio, and adopting new technologies to engage audiences.

Conclusion

Barry Diller’s talks with National Amusements for control of Paramount highlight the dynamic and competitive nature of the media and entertainment industry. As Diller navigates these discussions, the potential acquisition represents both a significant opportunity and a formidable challenge. The outcome of these negotiations could reshape the media landscape, bringing together Diller’s digital prowess with Paramount’s storied legacy. As the industry continues to evolve, the strategic moves by key players like Diller will be critical in defining the future of media and entertainment.

Diller’s pursuit of Paramount, amid the backdrop of Skydance’s failed merger and Sony’s reconsidered bid, underscores the high stakes and strategic importance of this iconic entertainment company. The coming months will likely reveal more about the progress and potential outcome of these negotiations, offering insights into the future direction of Paramount and the broader media industry.