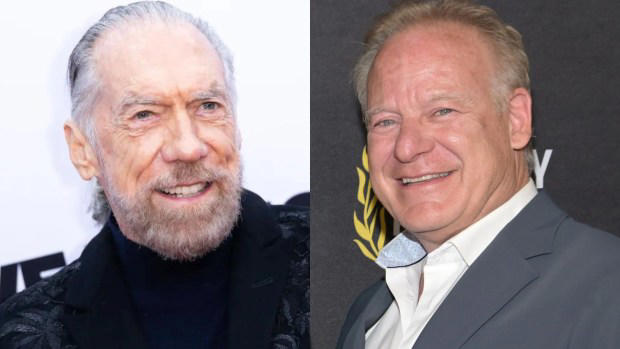

John Paul DeJoria, co-founder of Patrón, expressed confidence in securing support from Shari Redstone, the controlling shareholder of Paramount Global’s parent company National Amusements, for his bid alongside Steven Paul, the producer known for “Baby Geniuses.” In an interview with Fox Business’ “The Claman Countdown,” DeJoria indicated optimism about their bid’s potential success, emphasizing their commitment to maintaining the integrity of Paramount rather than breaking it up.

DeJoria highlighted his vision for Paramount Global if their bid succeeds, emphasizing a focus on injecting more positive content suitable for family viewing into the company’s media offerings. He stressed the importance of enhancing distribution channels and expanding the global reach of Paramount’s content to benefit both viewers and stakeholders alike.

This development follows Paramount’s recent strategic announcements under its new co-CEOs, Brian Robbins, George Cheeks, and Chris McCarthy. The trio unveiled plans for extensive cost-cutting measures totaling $500 million, strategic streaming partnerships, and potential asset divestments. Paramount’s initiatives include efforts to bolster profitability in its streaming business, with plans to increase streaming prices and explore asset sales like Pluto TV, BET, VH1, and potentially the Paramount lot.

DeJoria acknowledged these recent corporate strategies but indicated a readiness to reassess and potentially reverse some decisions once he and Paul gain control of Paramount’s board. He expressed confidence in completing the acquisition by August, citing strong investor support and a solid team.

Steven Paul’s investor group reportedly offered more than Skydance Media’s $2.25 billion bid but less than $3 billion. Meanwhile, Edgar Bronfman Jr., backed by Bain Capital, is reportedly considering a separate bid in the range of $2 billion to $2.5 billion.

Paramount’s stock has faced significant declines, reflecting broader market challenges, with a 15.8% decrease over the past month and substantial declines over longer periods.

Representatives for Paul and DeJoria, as well as Rockefeller Capital Management, Waverly Capital, Bain Capital, and National Amusements, declined to comment on the bids.