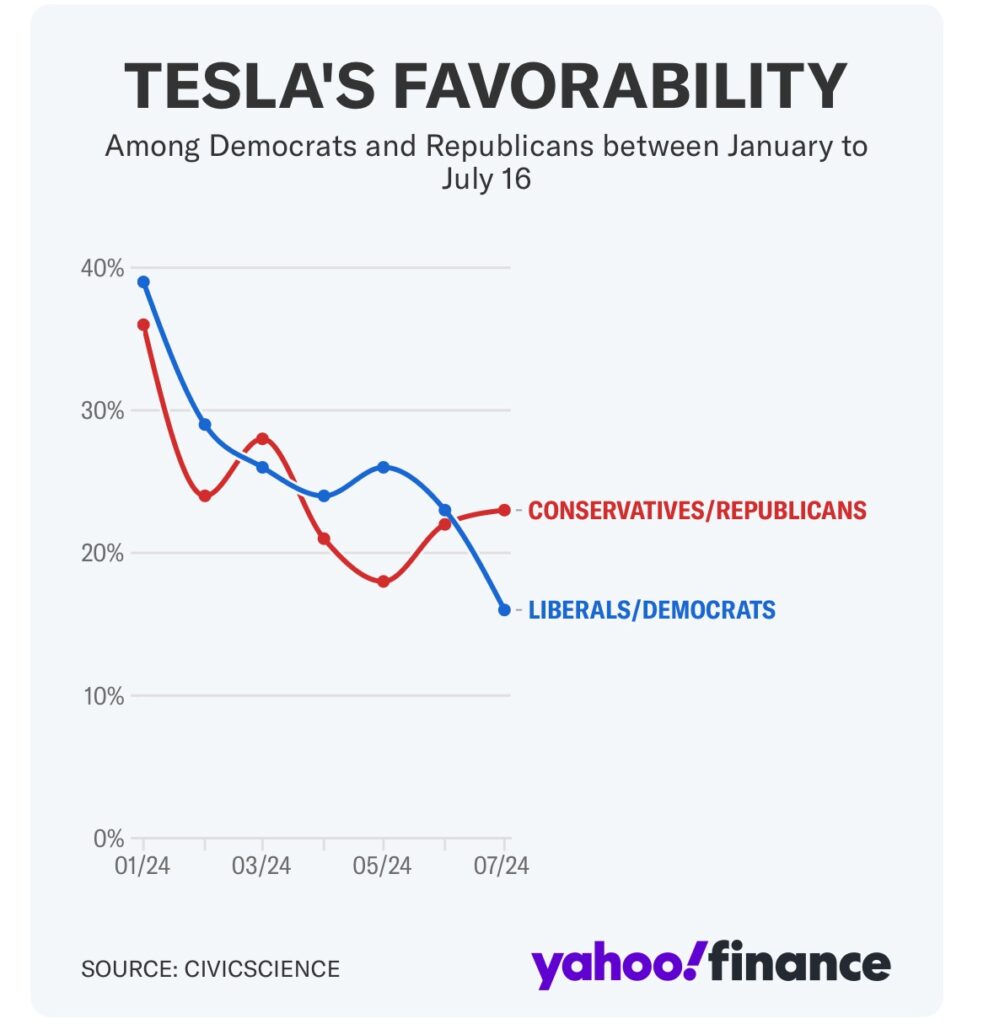

A rift is developing among prospective Tesla buyers over Elon Musk’s support of former President Donald Trump. A substantial drop in Tesla’s favorability ratings is evident, especially among Democrats, according to recent data from CivicScience. A sharp decline from 39% in January to 16% as of July 16 indicates how unpopular Tesla is among Democrats. The favorability rating among Republicans dropped within the same time period, from 36% to 23%. Elon Musk’s actions and the Tesla brand are strongly associated, especially with Democrats, according to John Dick, CEO of CivicScience, who also connects this tendency to this belief.

Tesla’s company may suffer significantly as a result of this change in perspective. The maker of electric vehicles (EVs) may suffer greatly from a Democratic boycott, according to short seller Mark Spiegel of Tesla. Spiegel called attention to the risk, saying, “He alienated the majority of his buying base utterly… The enterprise will be destroyed by it. I can’t think that many Democrats would be willing to purchase a Tesla at this time, if any at all. This opinion highlights how social and political controversy can affect customer behavior financially, especially for firms that have a close relationship with their well-known leaders.

Ross Gerber, a long-time Tesla investor and head of investment firm Gerber Kawasaki, expressed his personal discontent with Musk’s endorsement of Trump. Gerber mentioned that he is considering selling his Tesla vehicle, a Cybertruck, because Musk’s political stance does not align with his own values. Gerber stated, “This final stance of Elon has put me in a really difficult moral position. I’m driving a Cybertruck and now it’s like a MAGA truck.” This illustrates the profound influence that leadership and public statements can have on customer loyalty and brand perception.

The drop in favorability among Tesla’s Democratic customers is also reflected in data from Strategic Vision. The firm reported that the percentage of Tesla owners who identify as Democrats has fallen to 26%, down from 39% last year. This decline became more pronounced in November following Musk’s antisemitic comments on X, formerly known as Twitter, and has continued to decrease steadily since then. The political and social implications of these statements have evidently had a lasting impact on Tesla’s customer base, further complicating the company’s market position.

Tesla faces additional challenges beyond consumer sentiment. The political climate surrounding EV tax credits could significantly affect the company’s financial performance. Former President Donald Trump and his running mate, Senator JD Vance, have threatened to eliminate government subsidies for EVs, which would directly impact Tesla. Mark Spiegel pointed out that the loss of the $7,500 federal EV tax credit would force Tesla to raise its prices, likely leading to a reduction in sales. Spiegel noted, “If the $7,500 credit goes away, Tesla is going to have to raise prices. And if it has to raise prices, it’s going to sell fewer cars.”

Guggenheim analyst Ron Jewsikow emphasized the importance of the federal EV tax credit, calling it a “key affordability enabler” for Tesla. Jewsikow suggested that the repeal of this credit would have a negative impact on the company, making Tesla’s vehicles less accessible to a broader range of consumers. The potential loss of these subsidies adds another layer of uncertainty for Tesla and its investors, who must navigate the evolving political landscape and its implications for the EV market.

The issue of EV tax credits has been a contentious topic in US politics for years. Brian Sponheimer, a portfolio manager at Gabelli Asset Management, highlighted the political volatility surrounding these subsidies, describing the situation as a “political football.” Sponheimer urged investors to adopt a cautious “wait-and-see approach,” given the unpredictable nature of political decisions and their impact on the automotive industry. This cautious stance reflects the broader uncertainty in the market, where regulatory changes can significantly alter the competitive dynamics.

During his speech at the Republican National Convention, Trump did not hold back his opposition to the electric vehicle mandate. He declared that he would “end the electric vehicle mandate on day one — thereby saving the US auto industry from complete obliteration, and saving US customers thousands of dollars per car.” This stance highlights the potential policy shifts that could reshape the EV market and poses a direct challenge to companies like Tesla, which have built their business models around the growth and support of electric vehicles.

Elon Musk’s controversial statements and political endorsements have already had tangible effects on Tesla’s market performance. According to a report by Strategic Vision, the number of Tesla owners who identify as Democrats has dropped significantly. In addition, Musk’s antisemitic comments on X, previously known as Twitter, in November have led to a steady decline in the percentage of Democratic Tesla owners. This trend suggests that the social and political stances of company leaders can significantly influence consumer decisions and brand loyalty.

The broader implications of these developments extend to the potential financial challenges Tesla may face. The threat of losing the federal EV tax credit, a significant factor in making electric vehicles more affordable, poses a direct risk to Tesla’s sales and profitability. Mark Spiegel, a Tesla short seller, emphasized the potential impact, noting that the loss of the $7,500 credit would force Tesla to raise prices, leading to a decrease in sales. This potential scenario underscores the importance of government subsidies in the EV market and the financial vulnerability of companies like Tesla to policy changes.

Ron Jewsikow, an analyst at Guggenheim, further highlighted the critical role of the federal EV tax credit. He described it as a “key affordability enabler” for Tesla, suggesting that its repeal would have a negative impact on the company. The potential loss of these subsidies would make Tesla’s vehicles less accessible to a broader range of consumers, thereby affecting the company’s market share and financial performance. This adds another layer of uncertainty for Tesla and its investors, who must navigate the evolving political landscape and its implications for the EV market.

The issue of EV tax credits has been a contentious topic in US politics for years. Brian Sponheimer, a portfolio manager at Gabelli Asset Management, highlighted the political volatility surrounding these subsidies, describing the situation as a “political football.” Sponheimer urged investors to adopt a cautious “wait-and-see approach,” given the unpredictable nature of political decisions and their impact on the automotive industry. This cautious stance reflects the broader uncertainty in the market, where regulatory changes can significantly alter the competitive dynamics.

During his speech at the Republican National Convention, Trump did not hold back his opposition to the electric vehicle mandate. He declared that he would “end the electric vehicle mandate on day one — thereby saving the US auto industry from complete obliteration, and saving US customers thousands of dollars per car.” This stance highlights the potential policy shifts that could reshape the EV market and poses a direct challenge to companies like Tesla, which have built their business models around the growth and support of electric vehicles.

These political and societal disputes could have a large financial impact. Tesla is operating in a difficult climate due to the drop in Democratic support for the company and the possibility of losing important EV tax credits. Maintaining market position and growth in the highly competitive electric vehicle (EV) sector will depend heavily on the company’s ability to negotiate these political and social issues. The current developments are expected to have significant ramifications for Tesla’s future as well as the future of the electric car sector, thus investors, customers, and industry analysts will be keenly following them.

Regarding both prospective policy changes and customer reaction, Elon Musk’s support of Donald Trump is generating serious disruption for Tesla. Tesla is operating in a difficult climate due to the drop in Democratic favorability and the possibility of losing important EV tax incentives. Maintaining market position and growth in the highly competitive electric vehicle (EV) sector will depend heavily on the company’s ability to negotiate these political and social issues. The current developments are expected to have significant ramifications for Tesla’s future as well as the future of the electric car sector, thus investors, customers, and industry analysts will be keenly following them.

If you like the article please follow on THE UBJ.