Bruce Kamich’s astute analysis of Nvidia’s stock performance underscores the transformative potential of artificial intelligence (AI) and its profound impact on various sectors. While many investors initially underestimated Nvidia’s potential amidst recessionary concerns in 2023, Kamich’s foresight and meticulous evaluation enabled him to recognize the company’s promising trajectory.

Kamich’s bullish stance on Nvidia, which included a bold price target of over $750 per share, has proven to be remarkably accurate, reflecting his adept understanding of market dynamics and emerging technologies. As Nvidia’s highly anticipated AI conference approaches, investors are understandably eager to gauge the stock’s future trajectory and potential for further growth.

In his recent analysis, Kamich revisits Nvidia’s fundamentals and identifies key price points that could trigger shifts in investor sentiment. By providing updated insights and forecasts, Kamich equips shareholders with valuable information to navigate the evolving landscape of the tech sector and make informed investment decisions.

The anticipation surrounding Nvidia’s AI conference underscores the company’s pivotal role in driving innovation and shaping the future of AI-driven technologies. As stakeholders await the outcomes of the conference, Kamich’s analysis serves as a valuable resource for assessing Nvidia’s growth prospects and evaluating the sustainability of its remarkable stock rally.

Ultimately, Kamich’s expertise and rigorous approach to stock analysis offer invaluable guidance to investors seeking to capitalize on emerging trends and identify opportunities for long-term growth. Whether Nvidia’s stock continues its upward trajectory or faces potential headwinds, Kamich’s insights provide a solid foundation for informed decision-making in the dynamic landscape of the tech market.

Nvidia’s AI tsunami

The concept of artificial intelligence (AI) has been discussed for decades, with pioneers like Alan Turing and organizations like Rand Corp laying the groundwork for its development as early as the 1950s. However, it’s only in recent years that AI has transitioned from theoretical discussions to practical applications, thanks to advancements in technology and computing power.

The emergence of large language models, such as OpenAI’s ChatGPT, has played a significant role in democratizing AI and making it accessible to a wider audience. ChatGPT’s rapid adoption by millions of users highlights the growing interest and demand for AI-driven solutions in various sectors.

This surge of interest in AI has led to a flurry of research and development activities across industries. From financial institutions using AI to manage risks to healthcare companies exploring its potential in drug discovery, the applications of AI are diverse and far-reaching. Retailers are leveraging AI to enhance security measures and minimize theft, while manufacturers are incorporating AI to improve product quality and streamline maintenance processes. Even the military is examining AI’s implications for the battlefield.

However, the widespread adoption of AI has also revealed limitations in existing infrastructure, particularly in handling the complex computational workloads associated with AI algorithms. Traditional central processing units (CPUs) have struggled to keep pace with the demands of AI applications, leading to bottlenecks in processing power.

To address this challenge, cloud data providers like Amazon, Microsoft, and Google’s Alphabet are investing in advanced hardware solutions, including Nvidia’s graphics-processing units (GPUs). Nvidia’s GPUs are renowned for their computational prowess and are increasingly being adopted for AI-related tasks due to their efficiency and performance capabilities.

The soaring demand for Nvidia’s GPUs, coupled with favorable pricing and high profit margins, has fueled the company’s impressive financial performance. In the fourth quarter alone, Nvidia reported staggering revenue growth of 265% and a substantial increase in earnings per share, underscoring the lucrative opportunities presented by the AI market.

As AI continues to reshape industries and drive innovation, investments in advanced hardware solutions like Nvidia’s GPUs are poised to play a crucial role in supporting the growth and scalability of AI-driven applications across diverse sectors.

Nvidia faces challenges in 2024

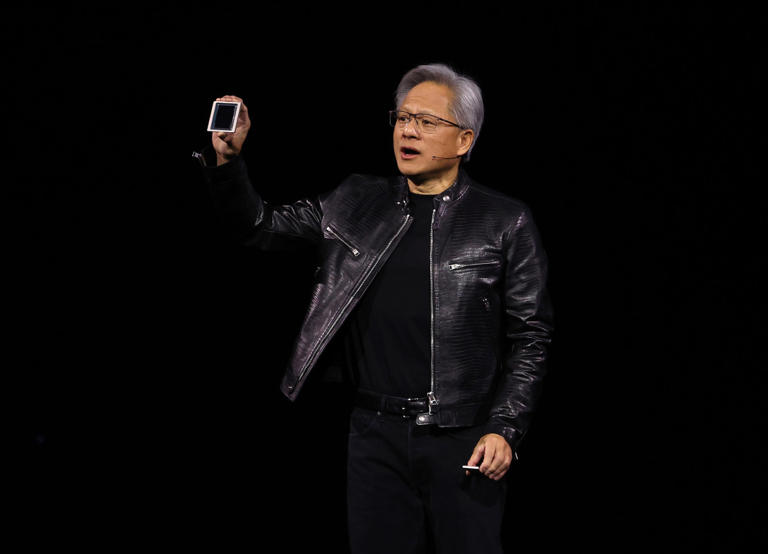

Nvidia’s CEO, Jensen Huang, is bullish on the growth prospects of the AI market, viewing it as a significant opportunity for the company. He anticipates that the increasing adoption of accelerated computing and generative AI will drive substantial growth in demand for Nvidia’s products in the coming years. Huang predicts that these trends will lead to a doubling of the world’s data center infrastructure installed base within the next five years.

Huang’s optimism about the AI market aligns with the sentiments of competitors like Advanced Micro Devices (AMD), which recently entered the AI chip market with its MI300X GPU. AMD’s CEO, Lisa Su, projects substantial growth in the AI chip market, estimating it to be worth $45 billion in 2024 and growing to $400 billion by 2027. This forecast indicates strong growth potential for AI-related technologies and underscores the significant market opportunity perceived by industry leaders.

However, Nvidia faces challenges on multiple fronts. The emergence of competitors like AMD in the AI chip market poses a threat to Nvidia’s market dominance. Su’s ambitious revenue targets for AMD’s data center GPU segment highlight the competitive pressures Nvidia faces in retaining its market share.

Moreover, Nvidia must navigate geopolitical challenges, particularly concerning its sales to Chinese companies. The U.S. government’s imposition of stringent performance restrictions on exports to China has limited Nvidia’s sales in the region. While Nvidia is working on developing new chips for the Chinese market, uncertainties remain regarding the success of these efforts amidst geopolitical tensions.

In summary, while Nvidia remains optimistic about the growth prospects of the AI market and its position within it, the company faces challenges from both competitors and geopolitical factors. Successfully addressing these challenges will be crucial for Nvidia to capitalize on the opportunities presented by the burgeoning AI industry.

Nvidia’s AI palooza kicks off new technology

At Nvidia’s annual GTC Conference in California, CEO Jensen Huang delivered a keynote speech on March 18, unveiling the company’s latest innovation: the Blackwell GPU platform. This new platform is poised to revolutionize the landscape of accelerated computing, offering significantly enhanced performance compared to Nvidia’s previous Hopper platform chips, such as the H100 and H200.

According to Huang, the upcoming Blackwell GPUs, including the B100 and B200 models, are expected to deliver a performance boost of 2.5 to 5 times that of the H100. This leap in performance is a testament to Nvidia’s commitment to pushing the boundaries of computing power and efficiency.

One of the standout features of the Blackwell GPUs is their improved energy efficiency. Huang highlighted that the Blackwell chip architecture consumes 25% less energy compared to its Hopper counterparts. This emphasis on energy efficiency aligns with Nvidia’s broader goal of developing sustainable computing solutions that minimize environmental impact.

In addition to the Blackwell GPUs, Nvidia also introduced other innovative solutions aimed at accelerating AI tasks while optimizing energy usage. Among these solutions is the Nvidia GB200 NVL72, a cutting-edge rack-scale design that integrates 36 Grace CPUs and 72 Blackwell GPUs. This powerful combination of processing units is poised to deliver unparalleled performance and efficiency in AI workloads.

Looking ahead, Nvidia plans to launch the B200 Blackwell GPU later this year, with an estimated price range of $30,000 to $40,000. This eagerly anticipated release is expected to further solidify Nvidia’s position as a leader in the AI computing industry, empowering organizations worldwide to unlock new possibilities in AI-driven innovation.

Nvidia’s stock chart reveals key price points

As Nvidia’s stock continues its impressive rally, investors are rightfully questioning whether the current excitement surrounding the company is already reflected in its stock price. Bruce Kamich, a seasoned technical analyst with over 50 years of experience, has been closely monitoring Nvidia’s price and volume trends to provide insights into potential market movements.

In early February, Kamich set a price target of $757 for Nvidia’s stock. However, his recent analysis has led him to revise his upside price target to the “$1,134 area.” Despite this optimistic outlook for the long term, Kamich has expressed concerns about potential short-term headwinds facing Nvidia’s shares.

One of the key indicators Kamich has been monitoring is the occurrence of a bearish engulfing pattern in Nvidia’s price chart. This pattern consists of a small bullish candle followed by a larger bearish candle that “engulfs” it, signaling a potential reversal in the stock’s upward momentum. Additionally, Kamich has observed heavy trading volume when Nvidia’s shares reached $950, suggesting increased investor activity and a possible inflection point.

Furthermore, Kamich has analyzed the Moving Average Convergence Divergence (MACD) oscillator, which measures the strength of a trend. He noted a narrowing of the MACD oscillator in recent sessions, indicating weakening trend strength in Nvidia’s stock price.

Considering these chart patterns and indicators, Kamich has identified several price levels that may trigger selling among short-term investors. These levels include $915, $875, and $855, where recent buyers of Nvidia’s stock may become anxious. Should Nvidia’s stock price weaken below the $855-$840 range, Kamich warns of the potential for further declines.

While point-and-figure (P&F) charting approaches provide valuable insights, it’s important to remember that they are not guaranteed predictors of future stock movements. However, Kamich’s analysis serves as a valuable guide for short-term investors navigating Nvidia’s current price levels, especially as the stock hovers around $900.