Chip giant AMD (AMD) recently reported its second-quarter earnings, which exceeded analysts’ expectations on both the top and bottom lines. This strong performance came amidst a dynamic landscape for the technology sector, driven largely by the growing importance of artificial intelligence (AI). AMD’s results reflect not only its success in capitalizing on AI trends but also its ability to navigate challenges and position itself strategically for future growth.

Earnings Performance and Revenue

For the second quarter, AMD posted adjusted earnings per share (EPS) of $0.69, surpassing Wall Street’s consensus estimate of $0.68. Revenue for the quarter reached $5.8 billion, exceeding expectations of $5.7 billion. This performance marks a significant improvement from the same period last year when AMD reported adjusted EPS of $0.58 and revenue of $5.4 billion. The company’s ability to outperform expectations is indicative of its strong market position and effective execution of its business strategies.

AI-Driven Growth

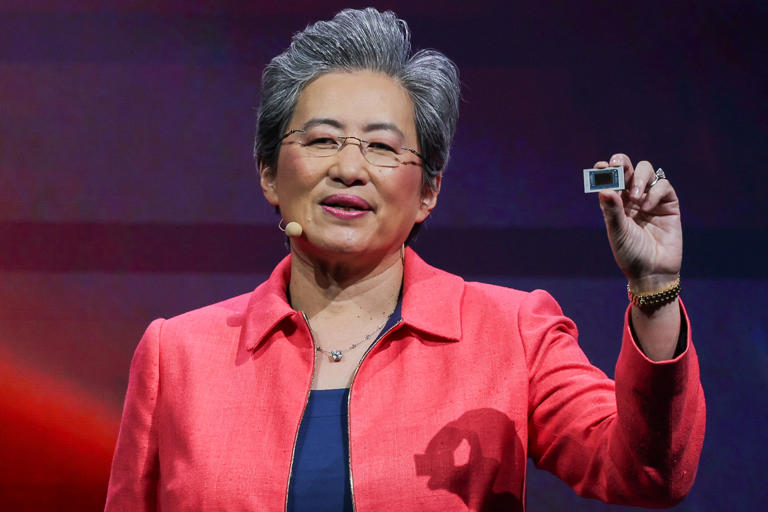

AMD’s CEO, Lisa Su, emphasized the accelerating growth of the company’s AI business, noting that the rapid advances in generative AI are creating significant opportunities for increased demand in compute power. Su highlighted that AMD is well-positioned to leverage these opportunities, particularly through its Instinct, EPYC, and Ryzen processors. These products are designed to meet the growing needs of AI workloads and are central to AMD’s strategy for capturing market share in this expanding segment.

Data Center Revenue Surge

A standout achievement in AMD’s earnings report was its data center revenue, which soared to $2.8 billion for the quarter. This figure not only surpassed analysts’ expectations of $2.75 billion but also represents a staggering 115% increase from the $1.3 billion reported in the same quarter last year. The substantial growth in data center revenue underscores the strong demand for AMD’s GPUs and CPUs, driven largely by the increasing adoption of AI technologies.

Stock Market Response

The positive earnings report had a favorable impact on AMD’s stock, which rose by as much as 5% following the announcement. This increase is reflective of investor confidence in AMD’s continued growth prospects. In comparison, shares of rival Nvidia (NVDA) also saw a 3% uptick, while shares of Intel (INTC) remained relatively flat. The performance of AMD’s stock highlights the market’s recognition of the company’s strong financial results and its strategic positioning within the semiconductor industry.

Advancements in GPU Technology

AMD’s advancements in GPU technology are a key component of its success. The company’s flagship GPU, the MI300X, has garnered adoption from major partners and customers, including Microsoft, Meta, Dell, HPE, and Lenovo. During the Computex event in Taiwan in June, AMD revealed its plans for future GPU releases, including the next-generation MI325X, which is expected to be available in Q4, and the MI350X, slated for 2025. Additionally, AMD announced plans for the MI400, set for release in 2026. These developments reflect AMD’s commitment to maintaining its competitive edge and meeting the evolving needs of the AI and data center markets.

Client and Gaming Segments

Beyond its AI and data center businesses, AMD’s Client segment, which encompasses sales of chips for PCs, reported revenue of $1.5 billion for the quarter. This result exceeded expectations of $1.45 billion and represents a significant increase from the $998 million reported in the same period last year. The performance of the Client segment is particularly notable given the recent challenges faced by the PC industry. After a period of slowdown following the pandemic-induced surge in PC sales, the industry is beginning to recover. According to IDC, worldwide PC shipments increased by 3% year-over-year in the second quarter, marking a positive shift after eight consecutive quarters of decline.

In the gaming segment, AMD reported revenue of $648 million for Q2, which, while down 59% year-over-year from $1.5 billion, still exceeded estimates of $646 million. The decline in gaming revenue reflects the broader slowdown in the gaming industry compared to the high-growth period during the early days of the pandemic. However, there is optimism for a rebound as upcoming releases, such as Nintendo’s new console and Take-Two’s highly anticipated “Grand Theft Auto VI,” are expected to drive renewed interest and sales in the gaming sector.

Outlook and Industry Context

AMD’s earnings report comes as the first among the major chip companies for this quarter, setting a high bar for its competitors. Intel is scheduled to report its earnings on August 1, while Nvidia will follow on August 28. AMD’s strong performance and positive outlook for the third quarter underscore its strategic advantages and robust market position. The company’s focus on AI and data center growth, coupled with its advancements in GPU technology, positions it well to capitalize on emerging trends and drive future growth.

In summary, AMD’s second-quarter earnings highlight the company’s successful navigation of a rapidly evolving technology landscape. The significant growth in data center revenue, strong performance in the Client segment, and advancements in GPU technology reflect AMD’s effective strategy and market positioning. As the company continues to leverage the AI boom and address challenges in its other segments, it remains well-positioned for sustained success in the semiconductor industry.