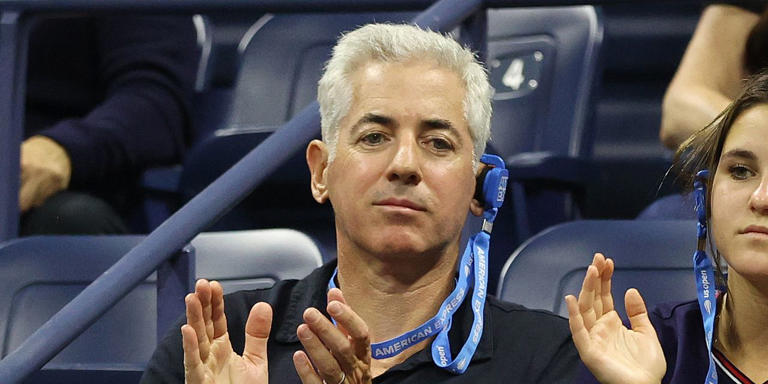

The timeline for the initial public offering (IPO) of billionaire investor Bill Ackman’s new investment vehicle, Pershing Square USA, has become more uncertain. Originally slated for next week, the IPO’s status was recently updated by the New York Stock Exchange (NYSE). The initial notice indicated that the IPO had been “postponed to a date to be announced,” but this was later revised to “pending on a date to be announced.” This update suggests that while the IPO is still planned, its exact timing is now unclear, and further information will be provided at a later date.

In response to these developments, Pershing Square USA issued a statement affirming its commitment to proceeding with the IPO, despite the delays. The fund confirmed that the IPO price would be set at $50 per common share, though the specific date for pricing remains undetermined. The postponement of the IPO, initially set for next week, has prompted questions about the reasons behind the delay. However, representatives from Pershing Square USA have not provided additional details regarding whether the delay extends beyond the originally scheduled timeframe.

Pershing Square USA is structured as a closed-end fund, meaning that it will offer a limited number of shares through its IPO. Once the shares are issued, the fund will trade on the NYSE under the ticker symbol “PSUS.” The fund has made a notable commitment not to charge performance fees on any gains, a move that distinguishes it from many other investment vehicles. The primary investment strategy for Pershing Square USA involves deploying capital into 12 to 15 large, “durable growth companies.”

The IPO’s fundraising goals have faced a significant adjustment. Initially, Ackman had aimed to raise up to $25 billion through the offering. However, in light of recent developments, the target has been revised downward to a range of $2.5 billion to $4 billion. This revision comes amidst a backdrop of scaling back expectations and addressing investor concerns. The adjustment reflects the challenges Ackman faces in convincing potential investors of the fund’s viability, especially given the closed-end fund’s historically mixed performance and the innovative nature of this offering.

Ackman has sought to bolster confidence in the offering through direct communication with institutional and high-net-worth investors. In a letter distributed earlier this week, Ackman highlighted the impressive track record of his hedge fund, Pershing Square Capital Management, and sought to address any concerns potential investors might have. Despite these efforts, Ackman acknowledged that participating in such a novel offering involves a “significant leap of faith.”

He elaborated that the initial $25 billion target may have influenced investor perceptions, leading to fears that the offering might be too ambitious. Ackman suggested that this initial high target could be beneficial in the long run by setting a high benchmark, which might make the revised target of $2.5 billion to $4 billion appear more achievable and realistic.

The letter also touched on the sensitivity surrounding the size of the IPO and the historical performance of similar closed-end funds. Ackman pointed out that the unique structure of Pershing Square USA and the past performance of such funds require careful analysis and judgment from investors. He remained optimistic about the eventual success of the offering, despite the hurdles faced.

As the situation continues to develop, market observers and potential investors will be closely monitoring for additional updates on the IPO’s timing and details. The adjustments to the offering’s timeline and fundraising targets reflect the complexities and challenges of launching a new investment fund in a dynamic market environment.