A crisis at the world’s most indebted company has worsened just after the news which had missed a crucial repayment deadline.

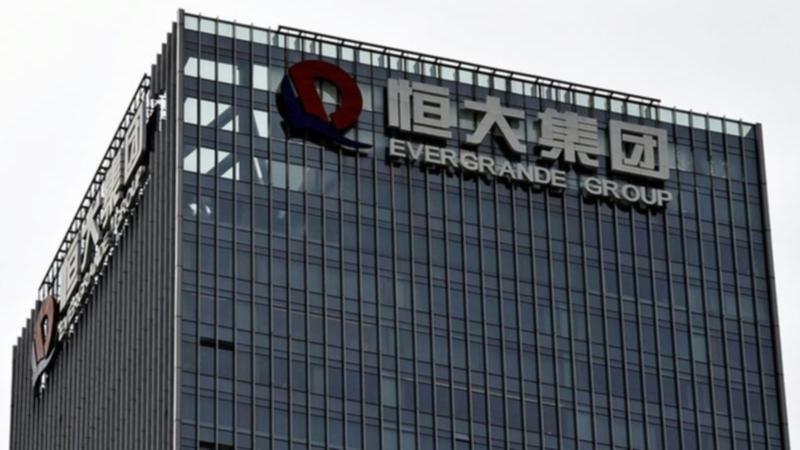

Evergrande, a Chinese property giant whose liabilities have exceeded $300bn (£228bn), and has failed to meet interest payments to international investors.

That prompted Fitch, an agency that rates companies’ financial risk, to declare Evergrande in default.

The crisis has also spooked the investors who fear contagion across China’s property and banking sectors.

Evergrande had been due to repay interest on about $1.2bn of international loans on Monday. But by Wednesday the money had still not been transferred.

On Thursday, Fitch which is one of the world’s biggest credit rating agencies, declared Evergrande in default, a move that could hamper the company’s restructuring talks with investors.

Fitch, whose risk ratings are closely followed by major investors seeking to deploy billions of dollars, said it contacted Evergrande about the non-payment but received no response. “We are therefore assuming they were not paid,” it said.

Businessman Hui Ka Yan founded Evergrande, formerly known as the Hengda Group, in 1996 in Guangzhou, southern China.

Evergrande Real Estate currently owns more than 1,300 projects in more than 280 cities across China.

The broader Evergrande Group now encompasses far more than just real estate development.

Its businesses range from wealth management, making electric cars and food and drink manufacturing. It even owns one of the country’s biggest football teams – Guangzhou FC.

Mr. Hui was once Asia’s richest person and, despite seeing his wealth plummet in recent months, has a personal fortune of more than $10bn (£7.3bn), according to Forbes.