Key Takeaways:

- New York Community Bancorp (NYCB) received a $1 billion investment from a group of firms led by Steven Mnuchin’s Liberty Capital.

- Mnuchin, along with two other investors, will join NYCB’s board of directors.

- Former Comptroller of the Currency Joseph Otting will take over as CEO.

- Trading in NYCB’s stock was halted following a Wall Street Journal report outlining the bank’s efforts to raise capital.

- The stock price plummeted initially but jumped after news of the cash infusion and leadership changes.

- Fed Chair Jerome Powell warned that banks may face challenges due to commercial real estate loan exposure for several years.

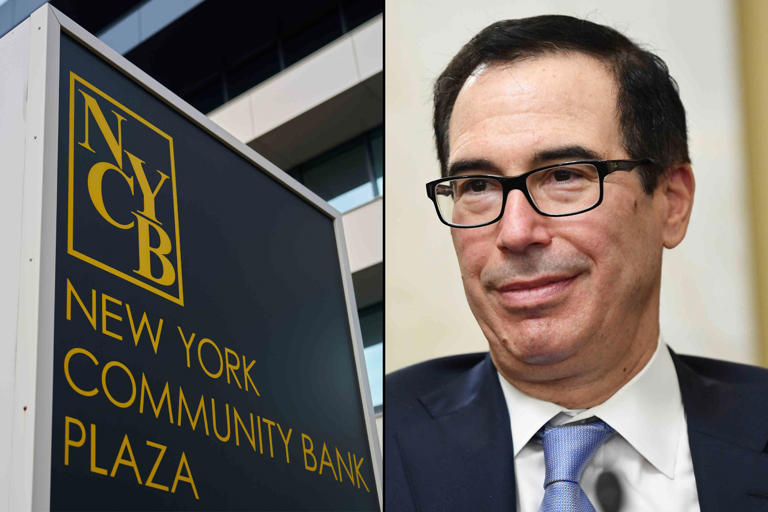

New York Community Bank (NYCB) faced a challenging situation on Wednesday as its shares plummeted by over 40%, prompting a halt in trading pending news. However, the troubled regional lender found a lifeline in the form of a $1 billion equity investment from a consortium of firms, led by former Treasury Secretary Steven Mnuchin’s Liberty Strategic Capital. This cash infusion provided a much-needed boost to NYCB’s financial position.

Notably, the deal not only injects capital but also brings significant changes to NYCB’s leadership structure. Mnuchin, along with three other prominent figures, will join the company’s board of directors. Allen Puwalski of Hudson Bay Capital, Milton Berlinski of Reverence Capital, and Joseph Otting, former Comptroller of the Currency, are among the new board members. Additionally, Otting will step into the role of NYCB’s new CEO.

Mnuchin emphasized the significance of the investment, stating that it positions NYCB with ample capital reserves to address potential future needs, including increasing reserves to align with or exceed those of its larger banking peers.

This development marks a pivotal moment for NYCB, as it seeks to stabilize its operations and chart a path forward under new leadership. The infusion of capital and the addition of experienced individuals to the board signal a renewed sense of confidence in the bank’s prospects. As NYCB moves forward, it will likely focus on leveraging this investment to strengthen its position in the market and restore investor confidence.

Trading Halted Amid Turbulence

The trading day for NYCB shares on Wednesday was marked by a pause in trading earlier in the day, triggered by a significant decline in response to a Wall Street Journal report detailing the bank’s efforts to raise additional capital. This drop represented the third such decline of substantial magnitude in just over a month, highlighting the persistent challenges facing the firm.

The first major slide occurred in late January when NYCB announced a dividend cut and a substantial increase in provisions for credit losses, which sent shares tumbling. Another sharp decline took place on March 1, following the replacement of the longtime CEO and the revelation of “material weaknesses” in internal loan review controls. These successive setbacks have eroded investor confidence and exerted downward pressure on NYCB’s stock price.

The bank’s struggles are largely attributed to its significant exposure to commercial real estate loans, which has unnerved both investors and creditors. Moody’s downgrade of NYCB’s rating, particularly to junk status in early February, further exacerbated concerns surrounding the firm’s financial health.

Despite the tumultuous trading day, NYCB shares managed to end Wednesday’s session with a gain of 7.5%, closing at $3.46. However, this uptick comes after the stock fell to as low as $1.70 earlier in the session. Despite the day’s gains, NYCB’s stock has still lost approximately two-thirds of its value since the beginning of the year, underscoring the ongoing challenges and uncertainties facing the bank.

Powell Says CRE Issues May Linger For Years

In his congressional testimony on Wednesday, Federal Reserve Chair Jerome Powell addressed growing concerns regarding regional banks facing challenges associated with commercial real estate loans. Powell acknowledged the ongoing discussions his team has been having with financial institutions to ensure they are adequately prepared for the inevitable losses stemming from these loans.

Powell emphasized that the issue of commercial real estate loans is not one that will dissipate quickly, stating, “It’s going to be with us as a problem we’ll be working through I think for several years.” He stressed the importance for banks to have sufficient capital, liquidity, and a well-defined plan to mitigate the losses that are expected to arise.

The challenges faced by banks with substantial portfolios of commercial real estate loans are multifaceted, as property owners struggle to lease office spaces and consequently face difficulties in meeting their debt obligations. The widespread adoption of work-from-home policies during the pandemic has exacerbated these issues, leaving many commercial properties vacant.

Powell noted that the Federal Reserve has primarily been engaged with medium- and small-sized banks regarding this matter, expressing confidence in the measures being taken. He stated, “I am confident that we’re doing the right things there. And I do believe it’s a manageable problem.” However, Powell also acknowledged the possibility of circumstances changing and pledged to provide updates accordingly.

Overall, Powell’s testimony underscores the Federal Reserve’s awareness of the challenges posed by commercial real estate loans and its commitment to working with banks to navigate through these difficulties effectively.