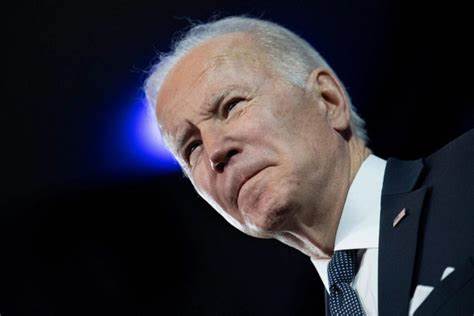

The recent embargo on AI chip exports to the Middle East imposed by the Biden Administration has sent shockwaves across the semiconductor industry, triggering a significant selloff in related stocks and ETFs. This move, specifically targeting high-volume sales to the United Arab Emirates and Saudi Arabia, has underscored heightened concerns regarding national security and the strategic control of critical technologies.

Notably, exchange-traded funds (ETFs) such as VanEck Semiconductor ETF (SMH) and iShares Semiconductor ETF (SOXX), which track the performance of semiconductor companies, have experienced sharp declines, reflecting investor apprehensions about the potential impact of export restrictions on the sector’s profitability and growth prospects.

At the forefront of the fallout are leading AI chip manufacturers like Nvidia Corp (NVDA) and Advanced Micro Devices Inc (AMD), whose business operations heavily rely on international sales. The embargo on exports to key Middle Eastern markets has raised questions about the resilience of their supply chains and the potential disruption to revenue streams.

The Biden Administration’s decision follows a series of similar measures taken against China in 2023, further exacerbating existing geopolitical tensions and adding complexity to global trade dynamics. Given China’s pivotal role in the semiconductor ecosystem as both a major producer and consumer, any disruptions to its access to critical technologies reverberate throughout the industry.

The ripple effects of the embargo have extended beyond NVDA and AMD, impacting a broad spectrum of chip-related stocks. Key suppliers and manufacturers, including Taiwan Semiconductor Manufacturing Co (TSMC), Broadcom Inc (AVGO), Qualcomm Inc (QCOM), Micron Technology, Inc (MU), Arm Holdings Plc (ARM), and Super Micro Computer Inc (SMCI), have all witnessed downward pressure on their stock prices in response to the heightened regulatory scrutiny.

Against this backdrop of uncertainty, industry stakeholders have converged at Taiwan’s Computex event to deliberate on the future trajectory of AI and its implications for semiconductor innovation. Amidst the prevailing challenges, analysts like Vijay Rakesh from Mizuho have maintained an optimistic outlook, citing upcoming catalysts such as Micron’s quarterly earnings report and the increasing integration of AI capabilities into consumer devices.

Rakesh emphasizes the growing trend of AI adoption at the edge, with original equipment manufacturers (OEMs) increasingly incorporating on-device AI functionalities into smartphones and PCs. This shift is anticipated to drive demand for memory and storage solutions, benefiting companies like Micron, Western Digital, and Seagate.

While the short-term outlook for chip stocks may be clouded by regulatory uncertainties, analysts foresee significant growth opportunities in the AI chip market over the long term, particularly within the smartphone and PC segments. However, the ability of companies to navigate regulatory challenges and adapt their strategies to the evolving geopolitical landscape will be crucial in determining their future success and resilience in the face of global disruptions.